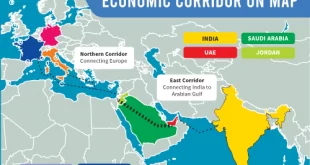

Key Points Beyond just building infrastructure, the India-Middle East-Europe Economic Corridor (IMEC) project has significant geopolitical relevance and can transform world power relations amid a rising regional and global rivalry for transportation corridors. The IMEC project is a game-changer since it intends to boost connection, enable sustainable growth, and revolutionize …

Read More »China, India and Turkey to siphon more Russian oil ahead of EU ban

NESREEN BAKHEIT and RURIKA IMAHASHI, Nikkei staff writers June 9, 2022 15:05 JST DUBAI/TOKYO — China and India are continuing to increase imports of Russian oil in a dramatic reshaping of global trade in energy, according to the latest industry data. But the ability of Asia to absorb more production …

Read More »Cheaper Russian oil is the scourge of cheap Iranian oil

Iran’s oil sales have risen under the Biden administration, but if the Ukraine crisis and Iran’s current policy in the nuclear talks continue, the US could tighten conditions for selling Iranian oil. Russia’s invasion of Ukraine has disrupted global oil trade and has given Iran the opportunity to increase exports to China, …

Read More »The Brewing Sino-Indian Conflict Over Iran’s Chabahar Port

Chabahar port could become a significant commercial outlet serving these countries, and it could also prove quite lucrative for Iran, which has struggled to raise funds in the wake of oil and gas sanctions. Iran’s strategic, geopolitical, and geoeconomic position has been carefully scrutinized by major countries around the world. …

Read More »Iran Oil Exports Face a Tough Future even after the Coronavirus

Even before the coronavirus pandemic erupted, Iran’s oil exports were declining as a result of secondary US sanctions. Global oversupply amid a drastic drop in consumer demand, caused by the virus and its economic effects, will likely continue to depress Iranian exports for months to come. Prior to the US …

Read More »