As Qatar sets higher ambitions for its gas output, Iranian officials scramble to justify their under-performance in developing the South Pars field, resorting to statistical maneuvers to deflect criticism.

Sakhavat Asadi, the chief executive of Iran’s Pars Special Economic Zone Organization, has claimed that Iran’s natural gas production from the joint Persian Gulf South Pars gas field (called North Dome by Qatar) surpasses that of Qatar’s. He boasted of Iran’s daily gas output from the field reaching a staggering 700 million cubic meters daily (mcm/d).

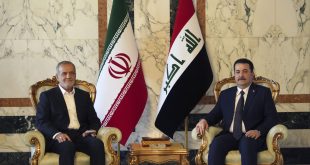

However, a report from the Iran National Gas Company, obtained by Iran International, presents a different perspective. It reveals that Iran extracted approximately 590 mcm/d of raw gases from South Pars during the first half of 2023, of which only 510 mcm/d of natural gas (methane) were injected into the network after processing.

Additionally, alongside 30 mcm/d of ethane, butane, propane, and other gases, approximately 6 mcm/d of the extracted raw gas comprised toxic gases like CO2 and H2S. Moreover, more than 7 mcm/d of the output is flared and wasted during the extraction and gas purification process, while 20.5 mcm/d is consumed directly in gas processing units as fuel.

However, in official statistics Iran insists that it produced 657 million cubic meters per day (mcm/d) of processed gas from all fields during the last fiscal year, beginning March 22, 2023, with approximately 78% (512 mcm/d) originating from South Pars.

Iran’s Oil Minister, Javad Owji, asserted last week during the Gas Exporting Countries Forum in Algeria that Iran is presently generating 1.07 billion cubic meters per day (bcm/d) of gas and aims to increase this volume to 1.3 bcm/d within five years through a $70 billion investment plan. However, his claim of a 40% overstatement in the current gas production level and the $70 billion investment plan in gas fields seem dubious, given that Iran’s annual investment in upstream oil and gas fields averaged only $3 billion in recent years.

First international and then US sanctions in the past 15 years have not only handicapped Iran’s investment capabilities but also access to Western technology, which are imperative for expanding production at the South Pars field.

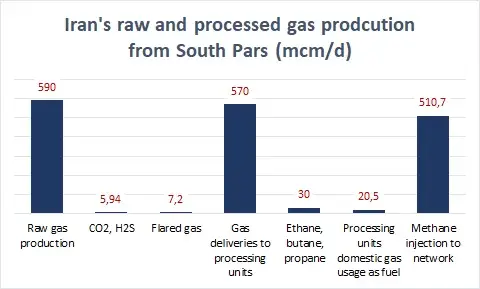

Qatar has been extracting gas from South Pars since 1990, a decade ahead of Iran, and has produced nearly double the amount of gas from the field. Despite this, Iran launched 14 new phases during the last decade and only recently reached Qatar’s production level.

In 2005, Qatar declared a moratorium on the development of the North Dome field to study the impact of rapid output increases on the reservoir. However, development resumed in 2022, with Qatar sealing $29 billion worth of agreements with Western companies to boost production by 30% by 2026, aiming to increase annual LNG export capacity from 77 million tons (110 bcm/yr) to 126 million tons per annum (mtpa) and projected to reach 142 mtpa by 2030. Consequently, Qatar’s total gas production from South Pars is expected to reach 740 mcm/d by 2030, while Iran’s production from this joint field is forecasted to decline by over 30% in a decade, dropping to approximately 350 mcm/d due to pressure fall on the Iranian side.

The Challenge of Pressure Decline and Engineering Mishaps

While Iran has recently caught up to Qatar’s daily production levels, the Iranian sector of South Pars is grappling with declining pressure. An assessment from the Iran National Development Fund suggests that a quarter of the country’s total gas production is expected to decrease by 2033 due to declining pressure in South Pars, which accounts for 78% of the country’s total gas production.

To stave off production decline, Iran faces the daunting task of installing 10 to 15 platforms, each weighing 20,000 tons—15 times the size of current platforms—equipped with massive compressors. This venture is estimated to cost a staggering $35 billion. Meanwhile, Qatar made strides in this direction years ago.

Meanwhile, Iran’s Oil Ministry inked a $20-billion deal with several domestic companies on March 10 to construct 28 platforms weighing 7,000 tons each, along with 56 compressors for the pressure-boosting initiative at South Pars. This decision comes despite the lack of experience among Iranian firms in manufacturing such equipment, and even Chinese companies are not equipped with the necessary technology. Chinese CNPC, previously part of the Total-led South Pars Phase 11 development consortium, withdrew from the deal a year after Total. Notably, half of the $5-billion contract value for the South Pars Phase 11 development was attributed to building a 20,000-ton platform with two massive compressors, a task exceeding the capabilities and technological expertise of the Chinese company.

Until recently, the wellhead pressure in the Iranian sector of South Pars remained steady at an average of 210 bars. However, since 2023, its pressure has started declining by 7 bars annually, resulting in a loss of 10 bcm each year. Significant pressure fall in Phase 12, the largest phase of South Pars, has already begun in recent years, with output levels declining from 65 mcm/d in 2018 to the current 43 mcm/d, according to a report from the National Iranian Gas Company, as seen by Iran International.

Iran had ambitious plans to produce 85 mcm/d of gas from Phase 12 by launching three platforms. However, due to erroneous drilling engineering at the location of the third platform, a substantial portion of its production turned out to be brackish water instead of natural gas. Consequently, production from this phase was slashed to 65 mcm in 2018 and dropped to 34% in 2023. Ultimately, Iran relocated the third platform from Phase 12 entirely to Phase 11 of South Pars last summer.

Across the 24 phases constituting the Iranian section of South Pars, approximately 10 wells have encountered engineering mishaps, resulting in the production of more brackish water than gas. In an effort to salvage production levels, Iran initiated Phase 11 of South Pars in August 2023 and launched a drilling spree. Additionally, the Iranian Ministry of Petroleum inked a deal in November 2023 to drill 35 new wells with domestic companies. However, while additional drilling may sustain gas production levels from South Pars in the short term, it is anticipated to hasten pressure decline in the Iranian section.

Iran’s only recourse lies in the installation of 20,000-ton platforms equipped with massive compressors—a technology monopolized by Western companies. Currently, all 24 phases of the Iranian side of the field are operational, leaving no room for the introduction of a new phase to bolster production or offset output declines from other phases.

South Pars Field

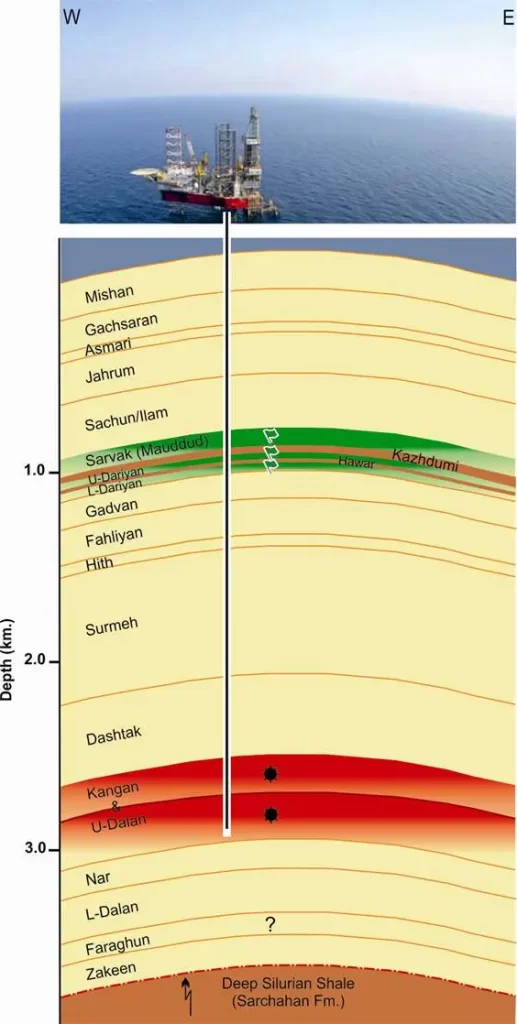

Stretching across an immense expanse of 56 trillion cubic meters, South Pars—also referred to as North Dome in Qatar—houses vast gas reserves, 70% of which are deemed recoverable. While two-thirds of the field lie within Qatari waters, the remaining third is situated within Iranian territory. To date, Iran has extracted 2 trillion cubic meters of gas from this field, equivalent to half of Qatar’s current production. The gas-rich Kangan and U-Dalan formations, known as the Khuff formation in Qatar, are nestled at a depth of approximately 3 kilometers. Comprising four layers (K1 to K4) with a thickness of 450 meters, these formations stretch from Iranian to Qatari waters.

Noteworthy is the inclination of this reservoir towards Qatar, with the flow of gas and gas condensates gravitating predominantly towards Qatar from Iran. Both countries are currently producing 650,000 to 700,000 barrels of gas condensate (ultra-light oil) daily from these four layers. Interestingly, Qatar’s total gas condensate production volume over the last three decades has been double that of Iran’s.

As Qatar’s production from this reservoir continues to rise and Iran’s output diminishes, the gas reserves of this formation are projected to gradually shift towards Qatar. Additionally, situated at a depth of one kilometer, this field harbors multiple layers of crude oil stretching from Iran to Qatar, making it a shared asset between the two nations.

Qatar commenced crude oil production from the oil layers of South Pars three decades ago, while Iran began tapping into these layers in limited capacities only since 2016. Conversely, while Iran allows extracted helium to dissipate and go to waste, Qatar has implemented the necessary equipment to capture and process this valuable gas since 2006. Currently, Qatar accounts for 35% of the world’s helium production and leads in terms of export volume, having exported 66 million cubic meters of helium in 2023.