On the heels of its latest forum in Algiers, the Gas Exporting Countries Forum (GECF) has grown substantially in size and influence, highlighting the essential role of natural gas in balancing global energy, promoting sustainability, and addressing market volatility, technological challenges, and geopolitical tensions.

The 7th Gas Exporting Countries Forum (GECF) Summit in Algiers marks a crucial moment for global energy. Amidst challenges in sustainability and economic development, it serves as a key platform for member countries to address pressing energy issues. In addition to exploring opportunities like the expansion of LNG supply and the role of natural gas in a clean energy transition, member nations must address market challenges like environmental regulations, the integration of renewables, and market volatility at the summit.

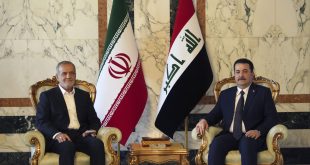

The Gas Exporting Countries Forum is anticipated to serve as a major force in the international gas market, somewhat akin to OPEC’s role in the oil market. This transformation will establish an organized market for gas, ensuring stability and prices while defending the interests of its members, who collectively account for 63 percent of global proven gas reserves. The GECF’s current members include Russia, Iran, Qatar, Algeria, Egypt, and Nigeria, among dozens of others. One of the main items on the agenda for the seventh GECF summit is the signing of a memorandum of understanding (MoU) with the Economic Research Institute for ASEAN and East Asia (ERIA) and the African Energy Commission (AFREC), demonstrating a determined effort to promote cooperation and collaboration across regions within the energy industry.

Challenges Facing the Gas Market

The demand for natural gas is anticipated to surge in the upcoming years, mostly from the chemical industry, power generation, home, automobile, and industrial fuel sectors. From 2023 to 2030, the market is anticipated to expand at a significant compound annual growth rate (CAGR). As part of this transformation, however, a number of challenges associated with the market—spanning economic, technological, geopolitical, and environmental factors—will also grow in size and scope. The foremost challenge for gas exporters is price volatility, which has made long-term investments in hydrocarbon exports difficult for risk-averse nations. Growing economic volatility, environmental concerns, and geopolitical conflicts all contribute to unpredictability in international markets. Global energy and gas prices, as well as market stability, are greatly impacted by geopolitical concerns like the trade war between the United States and China, the ongoing crises in the Middle East, and in particular Russia’s invasion of Ukraine in February 2022, which profoundly reshaped energy consumption patterns in Europe and led to significant distortions in the global gas market. Long-term instability and unpredictability are also exacerbated by the introduction of new technologies, rising oil production costs, and shifting global climate patterns.

The necessity for the oil and gas sector to transform is also being driven by the worldwide movement towards low-carbon alternatives because of climate change. Significant investments in infrastructure and other technologies are needed for this transformation. Given the anticipated increase in demand for low-carbon fuels, businesses who can transition to these sources of energy early on would stand to benefit in the long run. The transition to low-carbon fuels comes at the same time as growing environmental regulations on gas production and use; all throughout the world, governments are raising taxes on carbon emissions and enacting stricter guidelines for the production and transportation of gas and oil. Operating expenses will be impacted by these requirements, which demand large expenditures in renewable energy sources and technologies.

Other considerations are technological in nature. As a result of its growing reliance on complicated technology, the oil and gas sector is highly vulnerable to cyberattacks. Defending critical infrastructure and data against cyberattacks is one of the industry’s biggest challenges.

Infrastructure considerations are another challenge that many developing nations face when attempting to modernize or expand their gas export programs. It will be difficult to fulfill the increasing demand for natural gas and facilitate the switch to low-carbon fuels without first developing and updating the infrastructure necessary to extract and transport these fuels. This involves the requirement for financial expenditures in pipelines, LNG facilities, and carbon capture and storage (CCS) technologies.

Finally, long-term demand is at danger from supply and demand imbalances, especially in areas like Asia where high costs have already dampened demand for LNG. Furthermore, the invasion of Ukraine has forced a reevaluation of energy security plans throughout Europe. Concerns over the sustainability of gas consumption are developing as there is a movement to shift away from gas and toward renewables and low-carbon alternatives. In post-2022 Europe, energy markets are beset by both high prices and limited supplies. These difficulties are made worse by geopolitical tensions, which emphasize the critical need for energy source diversity to maintain stability and adaptability in the face of shifting geopolitical dynamics.

The Summit

The seventh GECF Summit, which took place in Algiers from February 29 until March 2, could profoundly influence the world energy scene in a number of ways. First and foremost, the summit emphasized the crucial role that natural gas plays in the world’s energy balance and promotes the energy source’s continuous usage as a dependable and (relatively) clean source of energy during the shift to environmental sustainability. Heads of state, ministers, and other officials from member and observer nations in attendance worked together strategically at the summit to promote greater interchanges within the gas industry. Furthermore, the summit underscored the need of research, innovation, and information sharing for the industry’s future achievements, particularly considering the opening of the Gas Research Institute headquarters by the GECF in Algiers.

The publication of the most recent Global Gas Outlook 2050 provides crucial information on projected market trends that will direct investment and policy choices in the direction of a sustainable energy future. Long-term energy security and market stability have been enhanced by tackling energy security issues through the “Algiers Declaration” and fortifying multinational alliances through various Memoranda of Understanding (MoUs). Additionally, the summit’s conclusions are well-positioned to impact international energy policies and practices, skillfully navigating the opportunities and challenges of the energy transition by highlighting adaptation to sustainable resources and investigating new partnerships in blue hydrogen production and carbon capture technologies.

The GECF’s Future

Building on the strategic initiatives highlighted in the Global Gas Outlook 2050 and the proactive measures taken through international cooperation, Qatar’s ambitious plan to expand its LNG production by 2030 exemplifies a tangible commitment to these global energy strategies. This move not only underscores the interconnectedness of environmental sustainability and economic strategy but also marks an important step towards reshaping the energy landscape to meet the demands of a rapidly evolving world.

Qatar has announced its intention to produce 142 million tons of LNG annually by 2030. Its increase in LNG production capacity strongly aligns with its goal of solidifying its global leadership in LNG, which might influence supply and pricing dynamics. These interconnected processes represent the complex interplay between environmental restrictions, geopolitical maneuvering, and the global desire for more dependable and sustainable energy sources.

Qatar’s growth may have a substantial impact on pricing and supply dynamics worldwide, changing the competitive landscape for LNG-producing countries. Furthermore, its calculated action highlights its ambition to reshape the energy scene with the goal of stabilizing the world’s energy markets and fostering economic expansion. Overall, the LNG market has seen a major shift in response to these intentions, which will have further knock-on effects on market dynamics, pricing patterns, and energy security.

As the GECF consolidates and makes steps to become a significant participant in the gas market, resistance from the United States and the European Union is anticipated, reflecting their past opposition to OPEC‘s cartel-like behavior in the oil market since the organization’s founding in 1960. Notwithstanding these obstacles, the GECF has agreed to build a top-notch ‘Gas Research Institute’ in Algeria, in recognition of the nation’s proficiency in gas and LNG technology. Algeria’s standing as an important gas producer and exporter, particularly to the EU after 2022, highlights how important a role it will play in determining the direction of the global gas market.

Ultimately, however the expected dispute with the Western gas importers plays out, the GECF is an essential platform for global energy discourse, technical innovation advancement, and collaboration amongst key gas-producing countries. It supports member nations’ sovereignty over their natural gas resources while promoting stability, security, and sustainability in global gas markets through its substantial membership base and strategic goals. Moreover, by formally cooperating with significant organizations like AFREC and ERIA, the GECF has sought to enhance information sharing, promote sustainable energy practices, and enable joint actions geared at solving shared challenges. These agreements provide a proactive approach to regional energy governance and operate as a catalyst for increased stakeholder engagement and integration in the promotion of energy security and sustainability agendas throughout Africa and the ASEAN-East Asia region.