NESREEN BAKHEIT and RURIKA IMAHASHI, Nikkei staff writers

June 9, 2022 15:05 JST

DUBAI/TOKYO — China and India are continuing to increase imports of Russian oil in a dramatic reshaping of global trade in energy, according to the latest industry data. But the ability of Asia to absorb more production will be tested as the European Union winds down imports from Russia in response to the invasion of Ukraine.

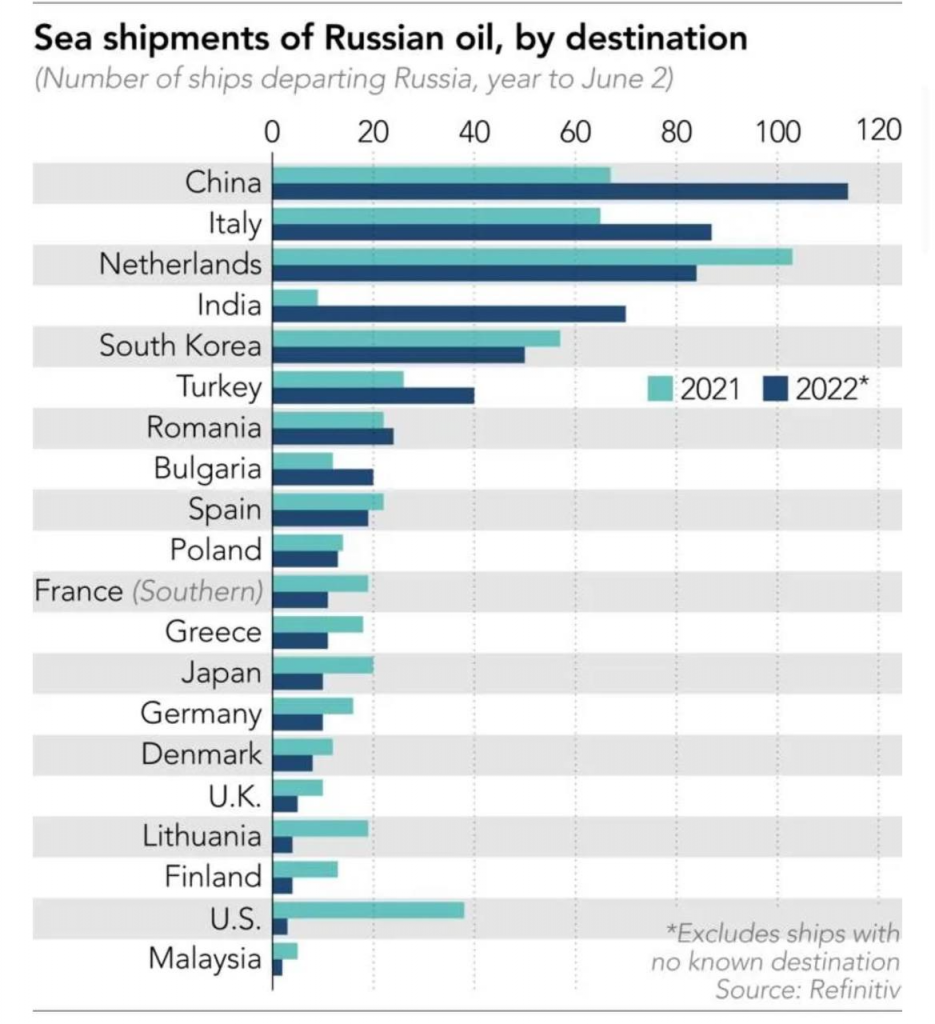

Between the start of the war on Feb. 24 and June 2, a total of 290 oil tankers departed Russia for Asia, according to a Nikkei Asia analysis of data from Refinitiv. That is up from 190 in the same period last year.

India, China and Turkey recorded the largest increases: nearly eightfold in the case of India, and 70% and 54% increases for China and Turkey, respectively.

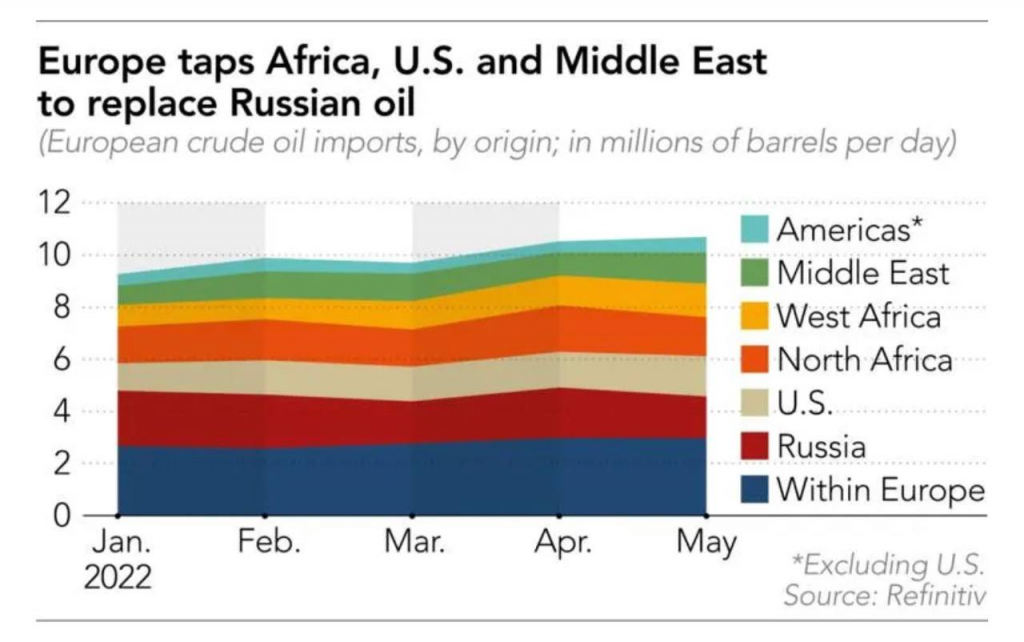

Meanwhile, the EU has increased its oil imports from other sources, including western Africa and the Middle East, in a harbinger of the shift that its 27 member countries must make later this year. The EU agreed last month to ban imports of Russian oil by sea from around the end of this year to increase financial pressure on the Russian economy and President Vladimir Putin. The EU’s largest countries also agreed to stop importing from Russia by pipeline.

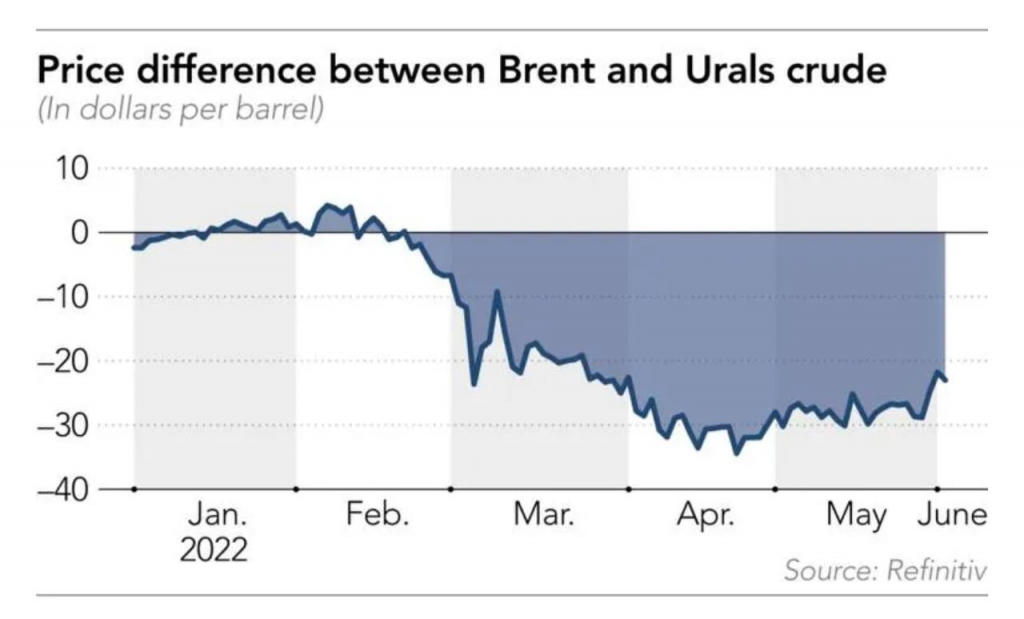

Increased Asian imports reflect opportunistic purchases of Russian crude from the Urals that now trades at lower prices than output from elsewhere, such as Brent crude from the North Sea. With oil prices elevated everywhere since the invasion, however, a barrel of Urals crude was recently selling for about $95, the same price as on Feb. 24.

“While the price of Russian crude has been somewhat discounted, Russia’s shipping of crude oil has not been significantly damaged,” said Tomomichi Akuta, senior economist at Mitsubishi UFJ Research & Consulting. “Russia keeps getting a certain level of income from oil.”

China imported 1.09 million barrels a day from Russia by sea in May, according to Kpler, a commodities research company, while India imported 740,000 barrels. That was up significantly from 910,000 and 284,000 barrels, respectively, in April, when the two countries jumped to take advantage of the discount. The averages for 2021 as a whole were 725,000 barrels a day for China and just 36,000 for India.

Kpler estimates around 800,000 barrels a day of Russian crude also goes to China overland — roughly 600,000 barrels a day through the Eastern Siberia-Pacific Ocean oil pipeline and another 200,000 barrels a day through Kazakhstan. This trade predates the invasion of Ukraine.

Giovanni Stanouvo, commodity analyst at UBS, predicted India, China and Turkey will continue to buy Russian crude, given the steep price discounts. But Tatsufumi Okoshi, senior economist at Nomura Securities, is skeptical China and India can significantly increase their purchases of oil from Russia from the current level.

“Both India and China have long-term oil purchase contracts with their oil suppliers in the Middle East,” Okoshi told Nikkei Asia. “Their basic stance is to buy cheap Russian oil in the spot market when it is convenient. I don’t think they will switch from the Middle East and buy a large amount of oil from Russia.”

As well as planning to curtail its own purchases of Russian oil, the EU is aiming to make it harder for alternative buyers to step in. It has banned European insurers from providing cover to ships carrying Russian oil — a ban that the Financial Times and others have reported may also be adopted by the U.K., home to the Lloyd’s of London insurance market.

Lloyd’s of London did not respond to Nikkei Asia’s request for comment.

The diversion of Russian oil and gas output to Asian markets requires costly new infrastructure and shipping capacity that will take years to build, said Umud Shokri, a Washington-based foreign policy analyst and author of “U.S. Energy Diplomacy in the Caspian Sea Basin.”

“Redirecting Russian natural gas to Asia from Europe would require building extremely long pipelines or specialized ports like the one on Russia’s Sakhalin Island,” he said. “Sending oil to Asia would require transportation by ship, but due to sanctions over the war in Ukraine, insurers are refusing to cover tankers with Russian cargoes. Banks are refusing to lend money for the time that the oil is in transit. So oil companies in countries like India have demanded very steep discounts on the price to cover the extra costs and risks.”

While the effect of the European restrictions will become more visible in the months ahead, the war has already caused some changes to the mix of imports to the EU, and differences have emerged between countries in the bloc.

EU imports have increased from west Africa — led by Angola, Nigeria, Cameroon and Gabon — the U.S. and the Middle East, notably Iraq and Saudi Arabia. The Urals crude that is still coming into Europe is more often headed toward the Mediterranean, with Italy taking proportionately more versus countries in northwest Europe.

Since many European refiners are set up to process Urals crude, the most similar substitutes would come from Saudi Arabia and Iraq. That could expand the market for Middle Eastern crude at the same time Asian refiners, some of its largest buyers, are picking up more from Russia instead.

Shukri told Nikkei Asia that “in the short term, Middle East producers such as Saudi Arabia, the United Arab Emirates and Iraq will not want to destabilize their OPEC relationship with Russia, but in the medium and long term, they would be willing to pump more oil to Europe.

Sultan Al Jaber, chief executive of the UAE’s state energy company ADNOC, told Nikkei Asia: “We are expanding our crude oil production capacity to 5 million barrels a day by or before 2030 and we are exploring the feasibility of pushing it higher.”

China’s imports from another source, the Atlantic Basin, have declined in tandem with its increased purchases from Russia. Specifically, west African shipments to China in April averaged 429,000 barrels a day, according to a provisional estimate from Kpler, the lowest in more than five years. The average in 2021 was 1.15 million barrels.

West African producers have struggled to ramp up production over the last few months.

Dmitry Marinchenko, senior director at Fitch Ratings, said they are already operating at full capacity. “They would need more investments and drilling,” he told Nikkei Asia. “The only two countries who have material spare capacity are Saudi Arabia and the UAE.”

While China and India can suck in most of the Russian crude, they may not absorb all of the output the country currently sends to Europe, Marinchenko said.

“Two to three million barrels a day of Russian oil may disappear from the market by the end of the year, as it will be lost and not go anywhere,” he said. “More customers are boycotting Russian crude, and the EU sanctions will lead to logistical bottlenecks and lack of access to western technologies needed for Russia’s declining oil field capacity.”