Iran’s Statistical Center recently announced a decline in the country’s unemployment rate to 7.6 percent this fall from 10.6 in the same period in 2019. The report didn’t explain the reason for the decline, but, a comparison of the new numbers for the labor force (employed or seeking jobs) with …

Read More »The U.S.-Iran Prisoner Swap: Unraveling Impacts on Gulf Security and Oil Dynamics

The recent agreement between the United States and Iran could portend well for regional security—or it could reinforce existing divisions and promote further escalatory behavior from each side, with significant economic consequences in either case. The recently announced prisoner swap between the United States and Iran has spurred debates about how it …

Read More »Iran’s oil and gas industry a year after the war in Ukraine

Introduction Despite its abundant oil and gas reserves, over the last four decades Iran has not been able to play a prominent role in the global energy market. According to energy industry statistics, Iran requires at least US$160 billion in investment to continue to export its oil and natural gas. …

Read More »Obstacles and opportunities for closer Iranian-Chinese economic cooperation

Iranian-Chinese economic relations have grown steadily closer over the past four decades, with Beijing emerging as one of Tehran’s leading trade partners in recent years. Their economic relationship entered a new phase in the 1980s, when China started providing Iran with arms and technology during the Iran-Iraq War. But since …

Read More »Iran and the Shanghai Cooperation Organization

While representing a major symbolic step, finalizing Iranian membership in the Shanghai Pact is not a panacea for the country’s current political, economic, and security challenges. Before the outbreak of recent mass protests, Iranian leaders were working to ameliorate their country’s international isolation through official membership in the Shanghai Cooperation …

Read More »Striking Oil: How Strikes in Iran’s Energy Sector Could Shape the Protest Movement

In 1979, oil workers in Iran dealt a blow to the Pahlavi dynasty; now, instability in Iran’s energy sector could once again put tremendous pressure on the regime or lead to the fall of the Islamic Republic itself. Considering the central role of energy exports to Iran’s economy, the security …

Read More »The United States Cannot Influence Global Oil Markets

Considering the increase in demand in the market and the concern of the producing countries about the future of the oil market, and the desire of these countries to increase the production capacity, it is not possible to expect the market to return to normal conditions in the short run. …

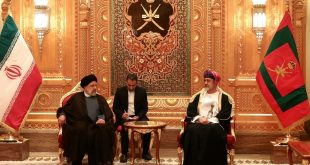

Read More »Regional security and energy are the main axes of Iran-Oman relations

Without the lifting of sanctions and a fundamental change in Iran’s foreign policy, it won’t be easy to resolve tensions in the region and increase the level of political and economic relations with neighbors. Regionalism and the development of Iran’s relations with Russia and China are among the presidency’s priorities in …

Read More »Iran Cannot Develop its Oil Sector Without Sanctions Relief

Iran can neither increase its oil and natural gas production capacity, nor attract the necessary foreign capital and technology for their expansion, without the lifting of sanctions. Thanks to a combination of Western animosity and Iran’s regional foreign policy, the country’s energy industry has faced ever more onerous sanctions in …

Read More »Cheaper Russian oil is the scourge of cheap Iranian oil

Iran’s oil sales have risen under the Biden administration, but if the Ukraine crisis and Iran’s current policy in the nuclear talks continue, the US could tighten conditions for selling Iranian oil. Russia’s invasion of Ukraine has disrupted global oil trade and has given Iran the opportunity to increase exports to China, …

Read More »