Biden’s LNG freeze makes little sense from both European and the US energy security perspectives. It won’t promote a green energy transition. Most energy experts acknowledge that LNG is the principal bridge fuel necessary for a green future. And if American LNG is not readily available, it will be replaced …

Read More »Shaping the Future: The 7th GECF Summit and Geopolitical Realities of the Gas Market

On the heels of its latest forum in Algiers, the Gas Exporting Countries Forum (GECF) has grown substantially in size and influence, highlighting the essential role of natural gas in balancing global energy, promoting sustainability, and addressing market volatility, technological challenges, and geopolitical tensions. The 7th Gas Exporting Countries Forum (GECF) Summit in Algiers …

Read More »Qatar’s Gas Ambition Affects Iran’s Reserves

As Qatar sets higher ambitions for its gas output, Iranian officials scramble to justify their under-performance in developing the South Pars field, resorting to statistical maneuvers to deflect criticism. Sakhavat Asadi, the chief executive of Iran’s Pars Special Economic Zone Organization, has claimed that Iran’s natural gas production from the …

Read More »Iran Faces Serious Challenges To Become An LNG Exporter

Iran, despite having the world’s second-largest natural gas reserves, has not yet become an LNG producer, and faces a critical shortage for essential domestic needs. Natural gas that has been cooled to a liquid form for convenient and secure non-pressurized storage or transportation is known as liquefied natural gas, or LNG. …

Read More »Iran Dreams Of Energy Cooperation With Russia

While none of the dozens of deals between Iranian and Russian oil companies over the past decade have been implemented, Russia now intends to export gas to Iran. It should be noted that due to European sanctions, Russia faced serious challenges in selling natural gas. Simultaneously, during the three-day visit …

Read More »Geopolitics Grants Omani LNG a Lifeline

The Russian invasion of Ukraine has given Oman’s natural gas industry, long handicapped by relatively modest reserves and high extraction costs, a new lease on life. The global energy crisis caused by Russia’s invasion of Ukraine one year ago has underlined the centrality of LNG to Europe’s energy security. Since …

Read More »Saudi Aramco’s U.S. Investments: A Win-Win Template for Bilateral Energy Engagement

As Saudi Arabia has grappled with its Vision 2030 reform plan and its transition away from fossil fuels, one international partner of choice in the energy sector has emerged: the United States In recent years, many countries in the Middle East region have concluded that their continued economic dependence on …

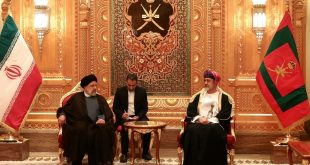

Read More »Regional security and energy are the main axes of Iran-Oman relations

Without the lifting of sanctions and a fundamental change in Iran’s foreign policy, it won’t be easy to resolve tensions in the region and increase the level of political and economic relations with neighbors. Regionalism and the development of Iran’s relations with Russia and China are among the presidency’s priorities in …

Read More »How Western sanctions over Ukraine invasion could hit Russia’s energy sector

Analysis: Tightening sanctions could lead to a decline in Moscow’s share of Europe’s energy market. Vladimir Putin’s invasion of Ukraine has posed several challenges for Western companies, with a growing list looking to exit Russia as international sanctions tighten. While Russian energy firms have not been sanctioned, a growing number of Western oil …

Read More »Exploring Alternatives to Russian Natural Gas, Europe Looks to the Gulf

Washington has deliberately increased its own LNG exports to Europe, and U.S. diplomats are trying to persuade Qatar to assist in meeting part of Europe’s natural gas needs, supporting the EU’s energy security as a traditional U.S. ally. The ongoing tensions in Europe between Russia and Ukraine have contributed to …

Read More »