Considering the increase in demand in the market and the concern of the producing countries about the future of the oil market, and the desire of these countries to increase the production capacity, it is not possible to expect the market to return to normal conditions in the short run.

Even before U.S. President Joe Biden visited Jeddah in mid-July, Saudi Arabia and the UAE had both committed to expanding their oil production in the coming months. In June, OPEC+ stated that it would increase its monthly production by 648,000 bpd in July, with a further equivalent increase in August. Taken together, this means that three months’ worth of increases will be achieved in only two months—a development likely to further drive down the price of oil independent of U.S. pressure. In an interview with Middle East Eye, Energy Intelligence research director Abhi Rajendran stated that it was not likely that the Biden visit would yield any further concessions, as the oil-producing nations of the Gulf would be looking to increase their own spare capacity, rather than release extra oil.

Limited Saudi Production Capacity

U.S. officials had previously said that Biden would discuss energy security with Gulf oil producers during his visit to Saudi Arabia, and hoped to see more OPEC+ steps to increase production. Saudi Crown Prince Mohammed bin Salman (MBS) promised on June 23 at a summit meeting between U.S. and Arab officials that Saudi Arabia would increase its oil production capacity from the current 12 million barrels to 13 million barrels over time, but he emphasized that these gains would occur over the next six years and not in the short term. He also stressed that “after that, the Kingdom of Saudi Arabia will no longer have the ability to increase its production capacity,” citing economies of scale and declining trends in the oil market. The Foreign Minister of Saudi Arabia, Faisal bin Farhan, also said immediately after the meeting that “there was no oil negotiation in this meeting.” In this way, the issuance of a joint statement by the United States, Saudi Arabia, and the United Arab Emirates regarding the agreement to increase oil production was rejected; further oil announcements will certainly not occur until a summit between the member countries of OPEC+ on August 3.

The increase in oil prices has a direct impact on the economy of major consumer countries, particularly in Europe. Russia’s invasion of Ukraine has increased concerns about energy security in Europe—concerns that only increased after the International Energy Agency (IEA) warned that measures needed to be taken to reduce Europe’s energy demand if the continent wanted to survive a winter without access to Russian oil. Following the U.S. failure to persuade MBS to expand Saudi oil production to reduce oil prices, multiple markets are facing energy constraints. Despite this, however, the securities markets have remained strong during 2022.

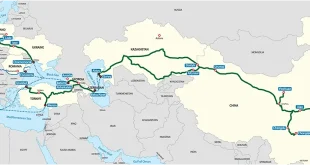

Sanctions levied against Russia in the wake of the invasion of Ukraine are pushing energy purchasers to seek alternative supply routes. Saudi ministers recently announced that the country would bring its production in line with OPEC+ frameworks. OANDA analyst Jeffrey Halley commented that despite supply risks and limitations in the futures markets, real world trade continues to uphold oil prices. Expectations of a possible downturn in demand saw oil prices fall recently, yet oil cargo is still being sold at a 14-year-high due to a shortage of crude.

Official data shows that between 2019 and early 2021, the United States saw a roughly 3 million bpd decline in oil production, which has since roughly doubled. Devon Energy and other companies abruptly reduced their drilling operations during the COVID-19 pandemic and global oil glut; according to industry statistics gathered by Baker Hughes, the number of active oil rigs decreased from 1,077 in late 2018 to 250 in mid-2020. Currently, oil equities have performed the best on the market, and neither investors nor businesses want to go back. Although Iran and Venezuela might increase their output if the United States were to decrease sanctions on Tehran or Caracas, the financial markets have remained apprehensive about these possibilities; Goldman Sachs has estimated that if sanctions were lifted, Venezuela could only add roughly 500,000 barrels per day and that Iran’s production would not substantially increase.

On the other hand, most American oil corporations are currently operating at their maximum output level. Jason Herrick, the owner of Pantera Energy in Texas, reported in June that he was attempting to extract more oil because of the historic rise in prices. However, like many other businesses in the U.S. and the global economy, Pantera has experienced significant delays related to the lingering consequences of the COVID-19 pandemic, which briefly drove oil prices negative and severely damaged Pantera’s cash flow. In the political sphere, this “rebalancing” has sparked worries in the U.S. because President Joe Biden had earlier made the fight against climate change a central part of his election campaign, leading to suspicions that he would push for legislation to limit greenhouse gas emissions and hasten the transition to renewable energy.

Irreplaceable Russian Oil

OPEC+ has a small margin for extra oil production, perhaps 2 million barrels a day—a margin insufficient to replace overnight all of Russia’s imports to Europe. Most of the excess production originates in Saudi Arabia and the UAE. MBS has clearly stated that further supplies will not be released, despite the Biden administration’s repeated requests for assistance. Curiously, although Russia has been heavily sanctioned by the United States and Europe, its oil exports have remained strong throughout the past six months.

In June, Bloomberg reported from a senior official of the Vitol Group, the world’s largest private oil trading company, that the United States would probably turn a blind eye to Iran’s sanction violations to control global oil prices. Mike Mueller, head of the Asian division of the Vitol Group, observed that the Biden administration might decide to turn a blind eye to illicit Iranian oil exports so that oil prices do not rise, with a view toward containing global gas prices before the upcoming midterm elections in November 2022. According to Mueller, Biden might even allow Iran to increase its oil exports without the renewal of the JCPOA nuclear agreement, which appears unlikely to succeed in the near future.

It is claimed that with the lifting of sanctions and the return of Iran to the market, the prices will stabilize in the market. However, considering the continuation of Iran’s oil sales to China and some European customers, it does not seem that the price will decrease with the return of Iran to the market. Keeping in mind that the Iran nuclear negotiations in Vienna have so far failed to reach an agreement and Tehran has continued its nuclear enrichment activities, sanctions could resume as Tehran turned off the International Atomic Energy Agency’s cameras in its nuclear facilities and is ignoring voiced concerns by the U.S. and EU.

Some U.S. lawmakers and commentators have speculated that Iranian officials may not be truly interested in reviving the nuclear deal and are merely trying to gain concessions from the United States and the other “P5+1” members without providing anything in return. Phil Flynn, a senior market analyst at the Price Futures Group, noted that although most estimates suggest that Iran’s daily oil production could increase by one million barrels a day, other estimates suggest that the production increase would be closer to 800,000 barrels a day if sanctions are eased in the coming months. In such a situation, oil prices can be expected to drop back toward $80 per barrel, although this step is far from certain and depends on the final outcome of the JCPOA talks.

Given these limitations, it seems likely that fluctuations in the global oil market will continue. The ongoing war in Ukraine, instability affecting Libyan oil supplies, and the failure of Iran and Venezuela to return to the oil market could cause an increase of oil prices. Europe must brace for a severe winter, and the energy security of European countries will face serious challenges in the coming autumn and winter. Considering the increase in demand in the market and the concern of the producing countries about the future of the oil market, and the desire of these countries to increase the production capacity, it is not possible to expect the market to return to normal conditions in the short run.