Introduction

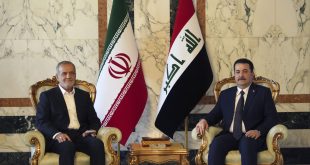

In a breakthrough deal, brokered by China, Saudi Arabia and Iran have agreed on the resumption of diplomatic relations and the mutual opening of embassies, a move that could change the balance of power in the Middle East and restore stability in the region. Under the agreement reached, the two countries will cooperate on many issues and try to further strengthen relations, seven years after Riyadh severed ties with Tehran when Iranian protesters attacked Saudi diplomatic missions in Tehran.[1] Though it is difficult to predict the future of Saudi-Iran relations, it is safe to say that tensions will continue to exist between these two nations for the foreseeable future.

The Saudi-Iranian rivalry has been ongoing for decades, with both countries vying for regional influence and dominance in the Middle East. However, recent developments suggest a shift in this rivalry, with both countries appearing more willing to engage in diplomatic talks and negotiations. One of the key reasons for this shift is the election of US President Joe Biden, who has taken a different approach to the region than his predecessor. With the change in administration, both Saudi Arabia and Iran appear to be more willing to engage in dialogue.

This article argues that despite the historic rivalry, there are signs of a shift toward a more cooperative relationship between the two countries. This is a significant development as the feud between the two regional powers has had a destabilizing effect on the region, contributing to conflicts and tensions in countries such as Syria, Yemen, and Iraq. The recent deal has paved the way for a new era of cooperation and dialogue between Saudi Arabia and Iran, which could have positive implications for the region.

This shift toward normalization will not be easy, and there are still significant obstacles to overcome. The fact that both countries are showing a willingness to engage in dialogue is a positive development that should be encouraged and supported by the international community. The changing dynamics in the region, including the normalization of relations between Israel and several Arab states under the Abraham Accords in 2020, have created a new environment for regional cooperation and diplomacy, as well as opportunities for new alliances and partnerships, which could help to resolve long-standing conflicts.

Saudi Arabia investment in Iran

One of the main areas of cooperation between Saudi Arabia and Iran might be investment into Iran’s energy sector. However, given the long history of strained relations between the two sides and the issues surrounding the Joint Comprehensive Plan of Action (JCPOA) – the nuclear deal between Iran and other major powers – it will be difficult for Saudi Arabia to directly invest in Iran’s economy. The JCPOA was designed to lift certain economic sanctions on Iran in exchange for Iran’s agreement to limit its nuclear program and allow inspections. Unless the JCPOA is revived, direct Saudi investment in Iran’s energy industry will be a difficult prospect.[2]

Nonetheless, there are positive intentions in Riyadh toward investing in Iran. Two days after announcing the normalization of Iran’s relations with Saudi Arabia, Saudi Finance Minister Mohammed Al-Jadaan asserted that after the agreement between Riyadh and Tehran, Saudi investment in Iran “could happen very quickly” as long as there was respect for sovereignty and non-interference in internal affairs.[3] During the Financial Sector Conference in Riyadh, Al-Jadaan said: “Our aim is to have a region that is stable, able to provide for its people, and prosper, and there is no reason for that not to happen, Iran is our neighbor and has been and will continue to be for hundreds of years […]. There are a lot of opportunities in Iran, and we provide a lot of opportunities, as long as goodwill continues.”[4]

Saudi Arabia plays a prominent role in the Arab world, so it is expected that Iran’s agreement with Riyadh will act as a prelude to greater agreement and cooperation with other neighboring Arab countries. This may also lead to greater cooperation with the Organization of Petroleum Exporting Countries (OPEC), as member states of this organization are aware that they sometimes need to make a compromise to reach a consensus. In this context, given its huge oil and gas reserves, the most important goal of Iran should be to regain the status it held within OPEC before it was subjected to sanctions by the US, as the current level of oil exports do not meet the country’s economic needs.[5]

Another potential field of investment is in renewable energy, where Saudi Arabia has greater competitive advantage than Iran. Riyadh launched an ambitious plan to develop its renewable energy sector, with the goal of reducing its reliance on oil and gas and diversifying its energy mix. The plan is part of the country’s broader Vision 2030 economic reform program, which aims to modernize the economy and reduce its dependence on oil exports.[6] As part of the plan, Saudi Arabia has set a target of generating 58.7 gigawatts (GW) of renewable energy by 2030, of which 40 GW will come from solar photovoltaic (PV) installations, 16 GW from wind energy, and 2.7 GW from other renewable sources, such as geothermal and waste-to-energy.[7] This is equivalent to about 30% of the country’s total power generation capacity.

Iran’s energy mix: Oil, gas, and renewables

Iran’s energy industry needs foreign financial resources and technology to develop its natural gas sector. In the last four decades, due to numerous sanctions, and lack of financial resources and advanced technology, Iran’s investment toward increasing the production of its oil and gas fields has been relatively limited. Increasing investment in the upstream field of Iran’s oil industry – including the exploration, development and exploitation of oil and gas fields – is important as the average age of oil infrastructure is high and the main oil fields are entering the second half of their economic life.

At the end of 2020, Iran announced its goal of achieving a production capacity of over 6.5 million barrels per day (bpd) by 2040. However, analysts believe that this is unachievable. Iranian output may pass 4 million bpd by 2025, but energy consultants FGE expect output to level out at just 5 million bpd by 2037.[8] In November 2021, Iranian oil minister Javad Owji stated that Iran requires oil and gas investments to the tune of US$160 billion to prevent it from becoming a net importer. Speaking at a budget planning meeting, the minister outlined how a lack of investment to date meant that the country is now in urgent need of this investment lest it becomes a natural gas and oil importer.[9] Any delay and shortfall in providing the required investments will lead to a reduction in the production capacity of oil and gas products from the current level as well as a reduction in safety levels, which in turn would lead to an increase in accidents in operational areas.[10]

Around 70% of Iran’s energy portfolio consists of natural gas, and the country has yet to tap into the potential of renewable energy.[11] Iran has good potential in this field, especially in solar and wind power, but the share of renewable energy in electricity production in Iran is a mere 1%.[12] Within the framework of its sixth five-year development plan (2016-2021), Iran was supposed to increase the share of renewable and clean energy to at least 5% of the country’s capacity by the end of 2021. However, the country is currently producing less than 1 GW of electricity from renewable energy sources.[13] In January 2022, the Iranian Energy Ministry announced that 10 GW of renewable capacity would be added by the end of 2026, in a bid to reach the long-term target of 30 GW.[14] The Renewable Energy and Energy Efficiency Organization (SATBA) subsequently signed a memorandum of understanding with private investors to deliver the plan, allocating US$71.5 million for the initial projects. The organization has stated that it has received project proposals totaling more than 80 GW.[15]

By comparison, Saudi Arabia has made huge investments in the renewable energy sector, with Saudi companies investing in the energy infrastructure of countries around the Caspian Sea basin and Central Asia. Considering Iran’s need to increase the role of renewable energy in its electricity production and the potential of Saudi companies, this sector can potentially become the focus of energy cooperation between the two countries in the medium term.[16] Moreover, further developing Iran’s renewable energy sector would also enhance its energy security through diversifying its energy mix.

Shared oil and natural gas fields

Iran shares more than 28 oil and gas fields with its neighbors in the north and south.[17] However, most of these fields have been a source of dispute between Iran and its neighbors, in terms of amount of exploitation and level of access.[18] Iran shares the Farzad (A, B) and Arash–Durra gas fields with Saudi Arabia, which also extends to Kuwait’s Arash field. The development of these joint fields could be another area of investment for Saudi Arabia.[19]

In May 2021, Iran’s Petropars, a subsidiary of the National Iranian Oil Company (NIOC), began development of the offshore Farzad-B gas field. Iran reportedly offered a 30% stake in the Farzad-B gas field development project to India’s ONGC Videsh (OVL) and its partners.[20] Located at water depths ranging from 20m to 90m, within the 3,500 km² Farsi offshore block, the Farzad gas and condensate field straddles the Iran-Saudi Arabia maritime border. According to estimates, the field holds approximately 23 trillion cubic feet of natural gas reserves and gas condensates of 5,000 barrels per billion cubic feet.[21] It should also be noted that, in 2002, the Indian consortium comprising OVL, the overseas investment arm of India’s state-owned Oil and Natural Gas Corp (ONGC), the Indian Oil Corporation, and Oil India secured an exploration service contract for the Farsi block.[22]

Iran’s stake in the Farzad-A field is approximately 25% and in the Farzad-B field approximately 75%.[23] However, Iran is not benefitting from this larger share in the Farzad-B gas field. With the pressure reduction on the drilled side, the gas on the undrilled side migrates to the drilled side, which has a lower reservoir pressure, thus benefitting Saudi Arabia. In addition, the amount of Saudi oil produced by this field is estimated at 500,000 barrels per day, while Iran produces less than 50,000 barrels of oil from this field.[24] This means that Saudi Arabia produces ten times the oil that Iran does from this joint oil field. Moreover, by increasing its oil production, Saudi Arabia increases its bargaining power in the international arena in various ways.

The Farzad field is not the only area of contention. In March 2022, Saudi Arabia and Kuwait agreed, despite Iranian objections, that they would jointly develop the Arash oil field. The field is known to have 20 trillion cubic feet of gas reserves, which could give an output of one billion cubic feet per day. Iran objected to this deal as it claims a share in the field and thus any agreements to exploit it must include Tehran. The Iranian Foreign Ministry stated that such a move was “illegal” as the boundaries of the field shared between the three countries had not yet been established.[25]

It is important to note that the issue of shared oil and gas fields is complex and will require sustained effort from both sides to address. There are legal and technical challenges that will need to be overcome, including issues related to resource ownership, production, and transportation. Developing shared fields also requires significant investment in pipelines, ports, and other infrastructure. However, cooperation between Saudi Arabia and Iran could help reduce the financial burden of these investments and lead to more efficient production and transportation of oil and gas. While restoration of diplomatic ties between Saudi Arabia and Iran is a positive step, it is only the first stage of a complex process. The potential benefits of increased cooperation in the development of shared oil and gas fields are significant, but there are also serious challenges that will need to be addressed if this process is to be successful.

Petrochemical industry

There are claims that Iran’s petrochemical industry is in competition with Saudi Arabia, and that this competition has led to losses for both sides.[26] However, through cooperation and agreement, the two countries could mutually benefit from each other’s production capacity. This cooperation could also extend to shipping in the region. By defining a common framework, Iran and Saudi Arabia could enable fair and high-quality competition.

In 2022, a survey by the Iranian Majlis Research Center predicted that Saudi Arabia could fare better in the field of petrochemicals than other countries in the region due to the positive actions it has taken in its petrochemical industry. According to the Center, the success of the Saudi petrochemical industry can be attributed in part to the existence of five-year plans for industrial development and the raising of the private sector’s contribution to GDP to 70%, as well as the creation of the industrial cities of Jubail and Yanbu, which are among the achievements of these five-year plans. Saudi Aramco, Jubail, Yanbu and SABIC are among the most important players in the petrochemical industry of this country.[27]

Taking into view Saudi Arabia’s advancement in this field, Director of the Planning and Development Department of the Iranian National Petrochemical Company (NPC), Hassan Abbaszadeh, said that in the previous Iranian calendar year (March 21, 2021 to March 20, 2022) the country exported petrochemicals to the value of US$15 billion. In August 2022, NPC’s Managing Director Morteza Shahmirzaei stated that for the present Iranian year, such exports were predicted to reach US$18 billion, which, according to Abbaszadeh, has been achieved in 10 months.[28] The petrochemical industry’s 10-year strategic plan predicts 35 projects with a nominal capacity of 13 million tons per year for the production of propylene. This will boost total propylene production capacity to 14 million tons, of which 11 million tons are to be consumed in polypropylene while the remaining is utilized by other sectors.[29]

Joint investment in the production and transportation of petrochemicals could help to reduce costs and increase efficiency, which would benefit both countries. Furthermore, given the global shift toward cleaner energy sources, both countries may have an interest in diversifying their economies and investing in new areas, such as renewable energy and petrochemicals produced from non-fossil fuel sources. The global petrochemicals market is highly competitive, with many other players vying for market share. Cooperation between Saudi Arabia and Iran could help to improve their competitiveness, though it remains to be seen whether they will be able to overcome their historical rivalry and work together effectively in this area.

Challenges to Iran’s energy ecosystem

The security of energy supply was one of the important factors behind China’s mediation between Tehran and Riyadh to normalize relations. On one hand, the ongoing sanctions imposed on Iran by the US have had a significant impact on Iran’s oil exports, with China being one of the few countries still willing to purchase Iranian oil. However, with the US continuing to tighten its sanctions regime, China may find it increasingly difficult to continue importing oil from Iran and may need to look to other suppliers to meet its oil needs. On the other hand, China wants to preserve its relationship with Saudi Arabia, which has traditionally been one of its most important oil suppliers.[30]

If the sanctions are lifted and Iran becomes a member of the Financial Action Task Force (FATF), and the restrictions imposed by the US on large companies are removed, the country will be in a favorable position to attract foreign investors, like Saudi Arabia. However, Iran failed to implement all the FATF directives by the deadline and must now start from scratch. Iranian President Ibrahim Raisi’s administration should take membership in FATF seriously, otherwise it will not be possible to attract foreign investments.[31] If Iran successfully acts on the FATF directives, the country will be moved to the grey list, under which it will subject to increased monitoring.[32] And if Iran manages to pass this stage, it will receive the final approval. However, given the conditions in Iran, this will likely take two years or more. The process of becoming a member of FATF can take a significant amount of time, as it requires Iran to implement a range of measures to address issues related to money laundering and terrorist financing, which can take between 18 and 24 months to complete.

Although the diplomatic reconciliation between Iran and Saudi Arabia has no potential effect on US sanctions or the volume of Iranian oil sales, some experts believe that this event can open new avenues for Iranian oil. Even if the sanctions are lifted, there may not be significant changes in the overall balance of the oil market, as data from oil tanker monitoring sources show that Iran’s oil exports to countries such as China are currently high enough. OPEC raised its forecast for China’s oil demand growth in 2023 due to the easing of COVID-19 restrictions in the country, but kept its estimate of global demand unchanged, pointing to possible downside risks to global economic growth.[33] Hence, Iran does not expect to see a huge increase in its oil exports to world markets, but if the nuclear agreement is restored and it returns to the market with the lifting of sanctions, it can pump more oil.

This means that the conditions for Iranian oil will remain the same as the last six months, in the most optimistic state, unless something worse happens, such as the tightening of the sanctions ring. Reports show that Iran’s oil exports last year reached their highest levels since the imposition of US sanctions in 2018. According to oil minister Javad Owji, Iran has exported 81 million barrels of oil since March 21, 2022, which is more than the previous twelve months and 190 million barrels more than each of the previous two years. Iran’s gas exports have also grown by 15% year-on-year.[34]

Conclusion

Energy geopolitics between Iran and Saudi Arabia have been a topic of great interest in recent years. As two of the largest oil-producing countries in the world, their relationship has a significant impact on the global energy market. However, the current state of their relationship is strained due to political and ideological differences. Despite these challenges, both countries have significant oil reserves and can benefit from joint ventures and partnerships. Furthermore, the global shift toward renewable energy sources presents an opportunity for the two countries to collaborate and invest in clean energy technologies.

Saudi Arabia may be interested in investing in, for example, Iran’s water, agriculture, and dairy sectors. It should be noted that Saudi banks do not have the possibility of directly investing in Iran in the form of Letters of Credit due to the FATF issue. However, potential investors may still buy shares of Iranian companies operating in those target sectors. The volume of Iranian oil exports is related to the issue of negotiations and sanctions; if the issue of sanctions is resolved, Iran’s role in OPEC will grow, but if the situation continues, it will hamper Iran’s position.

The recent diplomatic breakthrough has had a positive psychological effect on the market and has been effective in reducing and increasing the price of oil. In the oil market, an important factor is the competition behind the scenes, which cannot be dealt with easily. In the last decade, Russians and Saudis attempted to take over Iran’s oil market share, and they were successful. Iraq, Saudi Arabia, and Russia know that if Iran returns to the field of oil exports, their shares will decrease. Although an increase in Iran’s oil exports may upset the balance of the oil market, which is currently witnessing a delicate balance, the growth of Iran’s exports would be dependent on certain factors such as the lifting of sanctions to find a stable trend. If sanctions continue, Saudi Arabia might be interested in buying some of Iran’s petrochemical products. Since there is an incomplete production chain in Iran, Saudi Arabia might purchase primary petrochemical products from there, convert them into the final products and sell them in the market. Revenues from such sales could cover some of Iran’s urgent outstanding payments.

Although the competition between Iran and Saudi Arabia in the energy market will continue, the two countries should try to manage the current political tensions within the framework of their national interests. Saudi Arabia’s influence in OPEC will continue because it has the largest oil production capacity among OPEC members. Through the revival of the JCPOA and lifting of sanctions, Iran could take advantage of the financial resources of Saudi companies to complete renewable energy projects to solve the problem of power outages in the summer season. Given that production in Iranian oil and natural gas fields could interrupt Saudi Arabia’s market share, it appears unlikely that Saudis will invest in that sector. Saudi Arabia does not have a problem with Iran’s investment in shared fields, but without the financial resources and technology of foreign companies, Iran cannot increase its harvest from these shared fields with Saudi Arabia.

Altogether, the future of energy relations between Iran and Saudi Arabia is positive, but uncertain. The ongoing conflicts in the region and the geopolitical tensions between the two countries make it difficult to predict the direction of their relationship. While there are opportunities for cooperation, the political and ideological differences present significant challenges. Nevertheless, it is crucial for both countries to prioritize cooperation and dialogue to ensure stability in the global energy market.

References

[1] “Iran and Saudi Arabia Agree to Resume Relations after Years of Tension,” NPR, March 10, 2023, http://bitly.ws/BZGp.

[2] “Khandouzi’s Reaction to Saudi Investment in Iran,” Tejarat News, March 23, 2023, http://bitly.ws/BZHG.

[3] Natasha Turak, “Saudi Arabia Could Start Investing in Iran ‘Very Quickly,’ Finance Minister Mohammed Al-Jadaan Says,” CNBC, March 15, 2023, http://bitly.ws/BLXh.

[4] Nadin Hassan, “Saudi Arabia Open to ‘Quickly’ Making Investments in Iran: Finance Minister,” Arab News, March 15, 2023, http://bitly.ws/BZIw.

[5] “Tehran, Riyadh Expected to Seize Opportunity to Boost Ties in Oil, Gas Sectors,” Shana Petro Energy Information Network, March 18, 2023, http://bitly.ws/BZJb.

[6] Marvin Lee, “Saudi Vision 2030: What Are Saudi Arabia’s Plans for the Future?” Earth.org, September 21, 2021, http://bitly.ws/BZLc.

[7] Fahad Saleh Al-Ismail, Shafiul Alam, Md Shafiullah et. al., “Impacts of Renewable Energy Generation on Greenhouse Gas Emissions in Saudi Arabia: A Comprehensive Review,” Sustainability 15, no. 6 (2023), https://doi.org/10.3390/su15065069.

[8] “Iran Oil Minister Says Aiming for 1.4 Million bpd Crude Exports,” Reuters, March 20, 2022, http://bitly.ws/BZJu.

[9] Seth J. Frantzman, Why Is Iran Talking Oil Exports after Years of Sanctions? The Jerusalem Post, November 2, 2022, http://bitly.ws/C9CQ.

[10] “Iran Oil and Gas Industry Needs Investment,” Mizenaft, November 30, 2022, http://bitly.ws/BZIQ.

[11] U.S. Energy Information Administration (EIA), Country Analysis Executive Summary: Iran, November 17, 2022, http://bitly.ws/BZKy.

[12] “Only One Percent of Iran’s Electricity Produced Using Renewable Energy,” Bargh News, April 25, 2022, http://bitly.ws/BZKc.

[13] “Solving the Imbalance of Electricity and Gas with the Development of Renewables,” Donyaye-e-Eghtesad, January 20, 2023, http://bitly.ws/BZLz.

[14] Pooja Chandak, “Iran’s Renewable Energy Growth Continues to be Hindered by US Sanctions, Says Report,” Solar Quarter, October 13, 2022, http://bitly.ws/BZLS.

[15] Ibid.

[16] Tom Hussain, “UAE and Saudi Arabia Invest in Central Asia Renewable Energy Deals, with Russia’s Blessing,” SCMP, January 26, 2023, http://bitly.ws/BZKS.

[17] Dalgha Khatinoglu, “Shared Oil and Gas Fields of Iran,” DW, March 19, 2022, http://bitly.ws/BZMQ.

[18] Ibid.

[19] Nader Itayim, “Iran to Go It Alone at Offshore Farzad-B Gas Field,” Argus Media, May 17, 2021, http://bitly.ws/BZN2.

[20] “Iran Offers 30% Stake in Farzad-B Field to Indian Firms,” Offshore Technology, September 26, 2022, http://bitly.ws/BZND.

[21] Ibid.

[22] Ibid.

[23] Zahra Abdulahi, “Iran’s Oil and Gas Resources in Danger,” Tejarat News, March 12, 2023, http://bitly.ws/BZP6.

[24] Ibid.

[25] “Iran Says Saudi-Kuwaiti Deal on Durra Gas Development ‘Illegal’,” Reuters, March 26, 2022, http://bitly.ws/C5Kz.

[26] “We Must Coordinate with Saudi Arabia in the Field of Petrochemicals,” Bahar News, March 11, 2023, http://bitly.ws/BZPm.

[27] “The Iranian–Saudi Petrochemicals Competition,” Donya-e-Eqtesad, September 11, 2022, http://bitly.ws/BZPQ.

[28] “Iran’s Petrochemicals Export Reaches $18b Since Last March,” Tehran Times, January 31, 2023, http://bitly.ws/BZPG.

[29] Ibid.

[30] “China’s Oil Imports from Russia up 8.2% in 2022 to 86.24 Mln Tons — Customs,” TASS, January 20, 2023, http://bitly.ws/BZGR.

[31] Mehrnoosh Heydari, “Is Iran Attractive to Foreigners?: FATF Membership Should be Taken Seriously,” Khabaronline, August 30, 2022, http://bitly.ws/BZQj.

[32] FATF, “‘Black and Grey’ Lists,” http://bitly.ws/C67L.

[33] Alex Lawler, “OPEC Raises Chinese Oil Demand Growth View, Flags Econ Risks,” Reuters, March 14, 2023, http://bitly.ws/CtKo.

[34] Simon Martelli, “Iranian Minister Hails Rising Oil Exports,” Energy Intelligence, March 13, 2023, http://bitly.ws/BZQJ.