ran’s draft budget for 2024-2025, presented to the parliament, reveals a significant decline in oil and gas export revenues, and a surge in domestic energy prices.

The bill outlines a projection of 1.35 million barrels per day for oil exports at an average price of €65 per barrel (approximately $71) in the upcoming fiscal year (starting March 21), representing a 10% reduction in volume and a 16% decrease in prices compared to the current year’s budget. Despite these cuts, the overall forecast for oil revenues in the budget indicates only a 3% decrease from the current year, signaling a substantial increase in domestic energy prices, particularly impacting industries, businesses, and households.

Davoud Manzoor, the head of the Planning and Budget Organization, recently disclosed a 40% overestimation in oil export revenues for the current year, leading to a significant budget deficit. This suggests a shift toward raising domestic energy prices due to disappointment with oil export revenue growth, contradicting claims by Iranian oil officials, including the Minister of Oil, about an increase in the country’s oil production and exports.

International reports in August and Iranian official statements had indicted that daily exports had well surpassed 1.5 million barrels, but next year’s budget projection is based on the lower number.

Davoud Manzoor, the head of the Planning and Budget Organization

Data from the commodity intelligence company Kpler and energy consultancy firm Vortexa suggest that Iran’s daily oil exports to China have remained below 1.05 mb/d in ten month of 2023. Despite a notable summer increase, shipments declined in the fall.

Additionally, recent US legislation intensifying sanctions on Iranian oil, if implemented, could further restrict Iran’s oil exports.

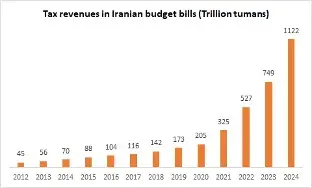

The draft budget for this and the next fiscal year does not distinguish revenues from the domestic and foreign sale of oil and gas. However, the government’s forecast of a 50% surge in next year’s tax revenues indicates that the Raisi administration aims to place a greater burden on the Iranian people to compensate for budget deficits.

Achieving expected oil revenues: aspiration or reality?

The Parliament Research Center has predicted that this year’s government budget will face a deficit of 4,250 trillion rials ($8.5 billion based on USD rate in Iran’s open market). This equals to 20% the current year’s budget. In recent years, Iranian governments, to compensate for budget deficits, have significantly increased taxes on people, traders, and industries, in addition to borrowing heavily from financial institutions and banks.

The Raisi administration also plans to increase the sale of bonds by 36% year-on-year to 2,550 trillion rials. For better comparison, the amount of government debt from the sale of bonds for the coming year alone will be equivalent to half of the total revenues from oil and gas exports and domestic sales.

International Monetary Fund (IMF) statistics show that government debt has sharply increased in recent years, reaching 34% of the GDP in 2022, or 118 billion dollars.

In the current fiscal year, the Iranian government has projected daily oil exports at 1.35 million barrels per day (mb/d) with a price of $71 per barrel. However, Iran’s actual daily oil exports to China, its main customer, hover just above one million barrels, and despite current global oil prices reaching around $74 per barrel, Iran offers a discount of about $12 per barrel to Chinese refineries. Consequently, approximately 30% of Iran’s oil export revenues are lost due to sanctions evasion and discounted sales to Chinese refineries.

As a result, not only is it unlikely that the targeted volume of oil exports will be realized in the budget for the next fiscal year, but achieving the predicted price for Iran’s oil exports is also improbable. In essence, the government is anticipated to face a considerable budget deficit in the upcoming year. The International Monetary Fund has forecasted that, to avert an Iranian budget deficit for the next fiscal year, global oil prices would need to exceed $317 per barrel.

Natural Gas Exports

In the current fiscal year, the Iranian government has set a target of 1.35 million barrels per day (mb/d) for daily oil exports, with a projected price of $71 per barrel. However, Iran’s actual daily oil exports to China slightly surpass one million barrels. Despite global oil prices reaching approximately $74 per barrel, Iran provides a discount of about $12 per barrel to Chinese refineries. This results in an approximate loss of 30% of Iran’s oil export revenues due to sanctions evasion and discounted sales to Chinese refineries.

As a consequence, not only is it improbable that the targeted volume of oil exports will be achieved in the budget for the next fiscal year, but attaining the predicted price for Iran’s oil exports is also unlikely. Essentially, the government is expected to confront a significant budget deficit in the upcoming year. The International Monetary Fund has forecasted that, to prevent an Iranian budget deficit for the next fiscal year, global oil prices would need to surpass $317 per barrel.

Dr. Umud Shokri, Energy Strategist and Senior Visiting Fellow at George Mason University