Due to geopolitical tensions and the growing need for minerals necessary for green technology, Ukraine’s vital mineral resources have drawn more attention from around the world. Ukraine, the second-largest nation in Europe, has abundant mineral resources, including sizable amounts of nickel, cobalt, graphite, rare earth elements, lithium, and titanium. Because of these resources, Ukraine might play a significant role in the global supply chain for essential minerals, providing a substitute for established suppliers and supporting Western nations’ attempts to diversify away from Russia and China. However, Ukraine’s capacity to utilize these resources has been significantly hampered by the ongoing conflict with Russia, which has presented both opportunities and obstacles for the growth of its mineral sector.

Ukraine’s Abundance of Critical Minerals

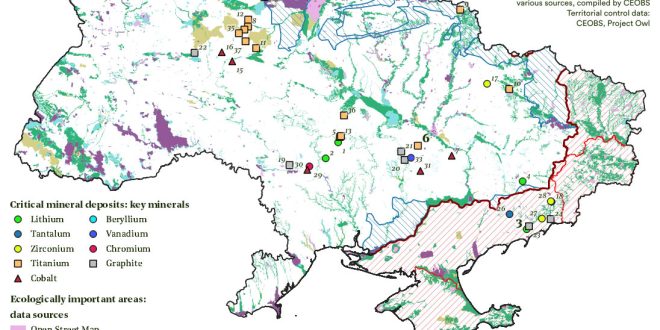

Ukraine is positioned as a potential global supplier in the highly sought-after mineral market due to its extensive reserves of vital minerals. About 20,000 different types of mineral deposits can be found in the country, making up around 5% of all mineral resources worldwide. Titanium, lithium, rare earth metals, graphite, cobalt, and nickel are important examples of these. Ukraine is one of the top producers of titanium in the world and has the highest deposits in Europe (7% of worldwide reserves).It is also one of the biggest deposits of lithium in Europe, with about 500,000 tons of proven reserves. Furthermore, Ukraine’s strategic significance in the global resource landscape is reinforced by its deposits of rare earth metals, including cobalt, nickel, and beryllium, gallium, and zirconium. Ukraine’s position as a vital mineral powerhouse is further cemented by its graphite reserves, which account for 20% of the world’s resources.

Strategic Importance and Economic Potential

Ukraine’s strategic importance is shown by the fact that it’s essential minerals are essential to many different sectors. Lithium is essential for battery manufacturing, especially in electric vehicles and renewable energy storage, while titanium assists industries like the automotive, medical, and aerospace sectors. Beryllium is used in nuclear power and defense, whereas rare earth elements like gallium are essential for semiconductors and LEDs. Furthermore, to produce green steel that complies with international sustainability standards, minerals like manganese and iron ore are necessary.

About 10% of Ukraine’s GDP and 33% of its exports came from the mining and metallurgical industry before to the Russian invasion. With an emphasis on luring in international investment and boosting output, especially of graphite, copper, and lithium—all of which are critical for developing technologies and the shift to green energy—the nation hopes to revive this industry after the war.

Challenges and Opportunities

Ukraine has a great deal of mineral richness, but it is difficult to properly utilize it. Supply chain failures, infrastructural damage, and industrial disruptions have all resulted from the ongoing confrontation with Russia. These problems have been made worse by Russia’s takeover of important mineral-rich areas. But the situation also offers Ukraine the chance to establish itself as a strategic ally for the US and the EU, who are both looking to diversify their mineral supply away from Russia and China. Ukraine could turn its vital mineral sector into a crucial component of its post-war economic recovery and geopolitical strategy by giving priority to investments in mining technologies, infrastructure development, and international alliances.

Impact of the Conflict on Access to Mineral Deposits

Ukraine’s ability to exploit its mineral resources has been significantly impacted by the conflict. Ukraine has lost access to vital resources, such as 65% of its coal, 33% of its mineral deposits, and 42% of its metals, because of Russia’s control of mineral-rich areas in the east and south. Furthermore, the extraction and export of these resources have been significantly impeded by destroyed mining and transportation infrastructure. Due to the closure of its main ports, Ukraine has been forced to export via slower and more costly train routes, which has raised prices and prolonged delivery times.

Significant investment uncertainty brought on by the conflict has also discouraged both domestic and foreign investors from making commitments to new initiatives or infrastructure development. Alumina is one industry where production has declined noticeably; between 2021 and 2022, Ukraine’s global ranking fell from eighth to sixteenth. Ukraine is now less competitive in the global market for essential minerals as a result. Notwithstanding these obstacles, Ukraine’s government is dedicated to growing its mining industry as a vital component of its post-conflict economic recuperation and inclusion into international supply networks. Ukraine wants to draw in foreign investment and fortify its geopolitical relations with the US and the EU by concentrating on minerals like lithium, titanium, and graphite.

Effects of the Blockade on Mineral Exports

Ukraine’s mineral exports have been severely damaged by Russia’s blockade of its Black Sea ports. Ukraine has been forced to switch to rail transportation after its sea connections were cut off, which has significantly increased logistical costs and slowed exports. Reliance on rail networks that cross adjacent nations like Poland and Romania has put a strain on resources and made exporting even more difficult. Additionally, delays and lower export volumes have resulted from the infrastructural limitations in European transit hubs. In addition to impeding trade, these logistical issues have diminished Ukraine’s reputation as a trustworthy supplier to international markets. Exports of steel production decreased from around 20 million tons in 2021 to an expected 5 million tons in 2023, an 80% decrease, while exports of metallurgical ore declined by almost 60% in 2022.The blockade has made it more difficult for Ukraine to compete in international markets for steel and iron ore, two industries that used to be important drivers of its economy.

In response, Ukraine has created alternate channels for logistics, such as barge transportation on the Danube River and rail and road networks linked to EU transit centers. Notwithstanding these endeavors, obstacles persist, such as exorbitant logistics expenses, border crossing capacity limitations, and disparate rail gauges. To fully restore export capacities to pre-war levels and modernize these channels, significant investments are required.

Strategic Partnerships and International Support

For the US and the EU, Ukraine’s vital minerals are strategically significant, particularly as both countries look to develop green technologies and lessen their need on authoritarian governments like China and Russia. The resources are essential for sectors that are essential to the US and EU’s technical and climatic ambitions, including defense, renewable energy, and battery manufacturing. Diversifying supply chains is made possible by Ukraine’s mineral richness, but achieving this potential will require overcoming the obstacles presented by the current conflict. In 2021, the EU and Ukraine inked a raw materials strategic cooperation with the goal of incorporating Ukraine into Europe’s expanding vital mineral networks and batteries value chain. Notwithstanding the difficulties, Western countries are dedicated to helping Ukraine’s mineral industry to boost its post-conflict rehabilitation and guarantee the security of vital mineral supplies for the rest of the world.

Conclusion

Ukraine’s vital natural resources have enormous potential for both bolstering geopolitical ties with the US and the EU and for the country’s post-war economic recovery. Ukraine’s enormous reserves of titanium, lithium, rare earth elements, and other minerals make it a potentially important player in the global supply chain for green technologies and critical raw materials, despite the difficulties brought on by the ongoing conflict with Russia, including interrupted production, damaged infrastructure, and logistical obstacles. Ukraine will require substantial infrastructural investment, ongoing international assistance, and regulatory changes to reach its full potential. If developed effectively, Ukraine’s mining industry may be a key component of the US and EU’s green technology transitions, strengthening Ukraine’s standing as a strategic partner in securing democratic and sustainable sources of critical minerals.