Despite close political relations with China, Iran has been largely left out of Beijing’s Belt and Road Initiative and other regional investments, amid US sanctions.

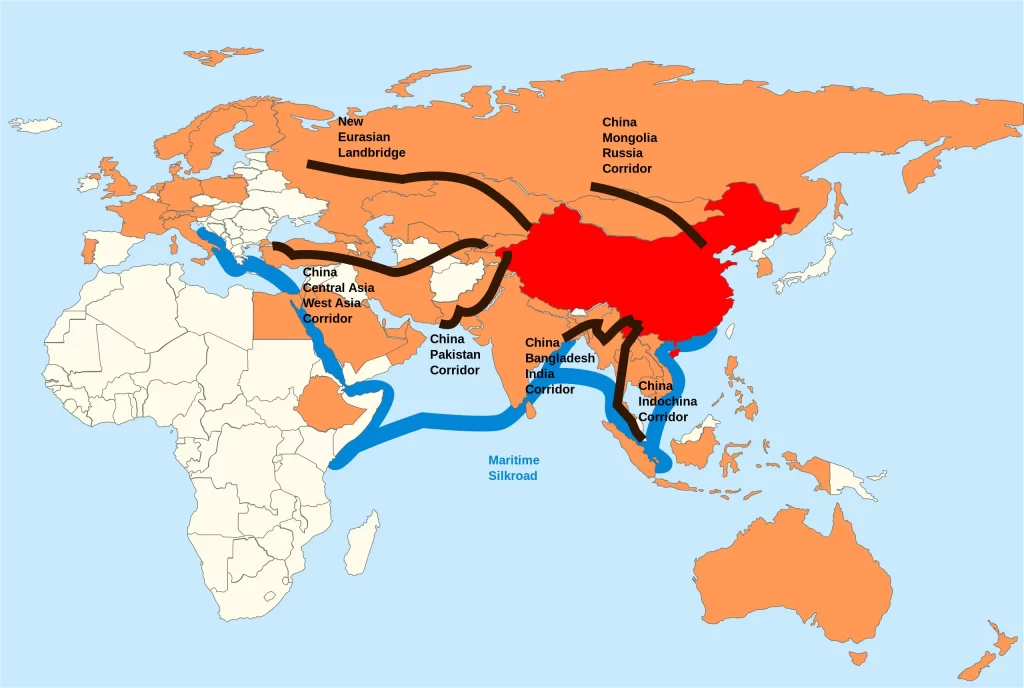

China is connected to Southeast and South Asia, Central Asia, the Pacific Ocean, Africa, and Europe through the Belt and Road Initiative (BRI), a massive global infrastructural project. With the purpose of strengthening regional integration, expanding trade, and supporting economic growth, it is centered around five key goals: policy coordination, facility connectivity, unhindered commerce, financial integration, and people-to-people bonds.

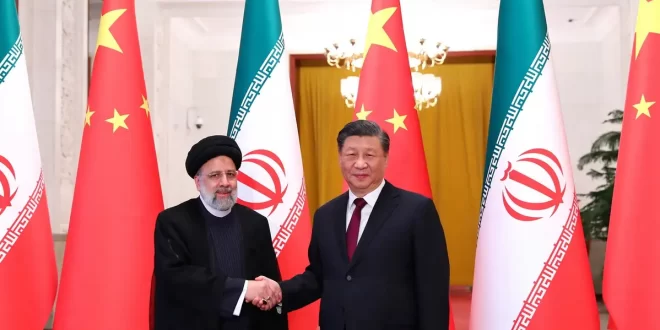

Beijing held the third Belt and Road Forum for International Cooperation, marking the BRI’s 10th anniversary, on October 17–18, 2023. The BRI Forum attracted international leaders of state and government, along with their delegations. As Xi Jinping’s major foreign policy program reaches its second decade, over 20 heads of state, mostly from the Global South, convened to debate it. The gathering was smaller than in the past, but it still showed the initiative’s importance in reshaping the world’s political and economic landscapes.

China investment on BRI

China started the $1-trillion Belt and Road Initiative (BRI) in 2013, with the participation of about 150 countries.

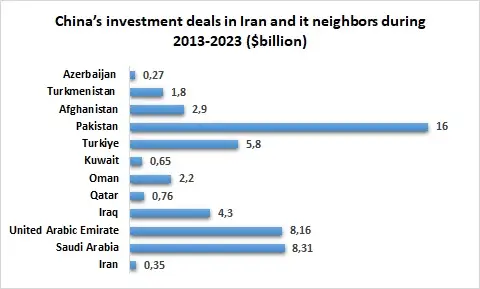

China itself, has directed $392 billion investments toward BRI, notably in Middle Eastern and Arab countries. However, it’s crucial to emphasize the limited investments in Iran, which casts doubts on the implementation of the 25-year strategic partnership agreement between China and Iran, that Tehran has advertised as a major foreign policy achievement. The outcome and influence of this agreement on Chinese investments in Iran, especially in sectors as critical as infrastructure and energy, remain uncertain. The intricacies of this partnership will undoubtedly shape the geopolitical and economic landscape of the region.

According to data from the American Enterprise Institute, China’s overseas investments from 2013 to 2023 amounted to a substantial $942 billion, of which $392 billion was related to BRI.

It has only signed two investment agreements with Iran during 2013-2023, of which one of them was canceled in 2018, when the United States left the JCPOA nuclear agreement with Iran.

One of the deals was investing in Iran’s South Pars gas field’s phase 11, which the Chinese CNPC energy company had committed in 2016 to invest $600 million but dropped the project in 2018.

The second scheme was the Gohardasht Steel project, which Chinese MMC had signed an agreement in 2014 to invest $350 million.

In contrast, Chinese enterprises have secured sizable contracts for investment and development with other regional nations. For instance, they have inked agreements with Saudi Arabia totaling up to $52 billion, with over $13 billion allocated for investment contracts.

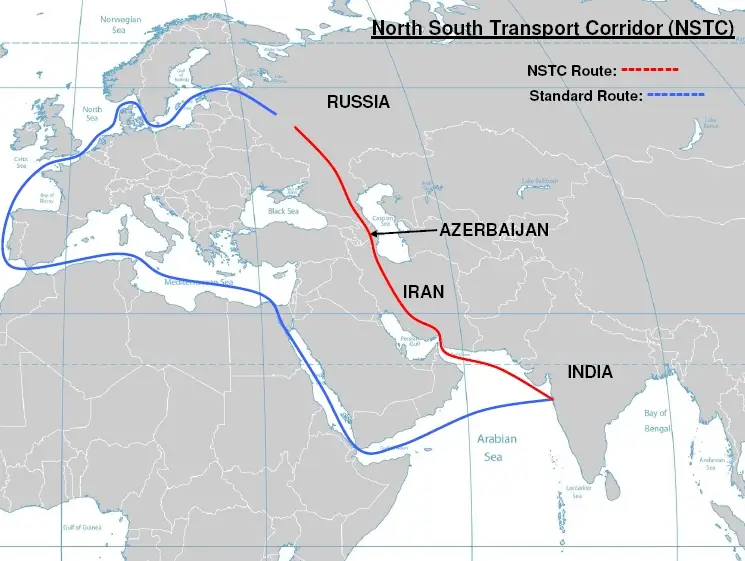

Iran remains out of transport corridors

Iran’s neighbor Iraq started a $17-billion road and rail project to link Asia and Europe in May 2023, while the India-Middle East-Europe Economic Corridor deal was signed in September 2023.

During last years, China has developed huge transport projects in Pakistan, while Central Asia-Caucasus-Turkey became the major land route for transportation cargoes in East-West direction.

Therefore Iran remained out of all transit projects in the region.

For instance, Azerbaijan has transited 7.5 million tons of foreign cargoes in 2022 through railroads – about 3.5 times more than Iran- of which 2.9 million tons was from East to West direction (China- Europe), about 15% more than 2021.

The country also expanded north-west (Russia-Turkey) and north-south (Russia-Iran) railroad transit routes. Its rail transportation from these routes increased 45% year-on-year as well.

Azerbaijan has also developed road and marine cargo capacities. Its marine cargo transit increased by 41% in 2022.

It also opened the Baku-Russia highway in October 2023. There is another transit road, inaugurated several years ago, connecting Baku to Astara in Iran.

Only using Azerbaijani rail lines, the transportation of products between Russia and Iran last year showed a phenomenal surge of 90%, reaching 1.7 million tons. Azerbaijan plans to increase cargo transit through North-East to 15 million tons annually via railroad, roads and the Caspian Sea.

Based on Iranian customs statistics, 57% of Iran’s exports to Russia pass through Azerbaijani soil, while 42% traverse the Caspian Sea, mostly by Azerbaijani shipping lines.