Currently, Mediterranean coastal countries are increasingly seeking to extract gas from the Mediterranean seabed. As the first step, these countries have undertaken numerous excavations for domestic consumption to sell the gas in a regional consumption market such as the European Union if domestic infrastructure is provided in the coming years.

In the meantime, some countries will have the opportunity to take advantage of their right to transport gas to the consumer market, and by diversifying their sources of gas, will be able to guarantee their energy security.

The discovery of new energy sources has always provided governments with an opportunity to invest in these fields in a timely manner, to meet their domestic needs to a certain extent and to have more bargaining power to sell them locally and globally.

The growing need of major energy-consuming countries has always been an important factor in determining the market for old and new energy sources. Today, increasing the share of natural gas in the energy basket of major consumer countries has led to a shift in the geopolitics of energy from oil to gas, and huge gas resources in the Mediterranean can also be an important part of the geopolitical shift of energy from oil to gas.

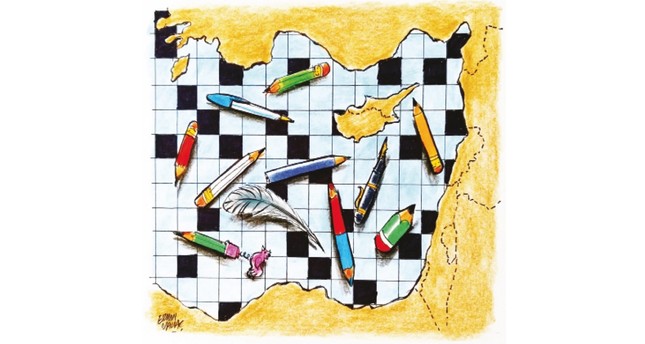

Growing competition

Increased gas exploration activities in the region have increased the competitiveness of coastal states in those areas. Recent excavations in Turkey, on its coasts and in specific areas near the Turkish Cypriot sector, are being followed with sensitivity by Greece and the Greek Cypriot sector. Increasing Turkish activity in the region, if combined with the discovery of gas resources, could lead to a shift in the balance of power in the region.

The need for joint investment in the exploitation and export of energy resources in the region has also created new political and economic polarization in the region. In recent years, numerous meetings have been held between the Greek, Cypriot and Israeli authorities. The purpose of the meeting was to strengthen cooperation between the three countries, especially regarding Mediterranean energy resources.

Israel’s policy

Israel has developed a special plan for the use of gas resources in the Mediterranean. In the same year, a similar meeting was held in Cairo with Israeli leaders, Greece and Egypt, whose main focus was on exploiting the resources of the Mediterranean. Turkey’s political differences with these countries have made it unable to play an active role in the region’s energy equations for some time.

In February, Israel and Egypt signed a $2 billion gas export contract. Under the deal, Israel’s Delek Energy Company, along with Nobel, will export 2 billion cubic meters of gas from the Leviathan and Tamer fields to the private Egyptian company Dolphinus. Signing the deal has brought Egypt and Israel closer in regional and global issues. Delek Company official statistics show that the gas reserves in the two Leviathan and Tamer fields will total more than 2 billion cubic meters.

Israel, Greece and the Greek Cypriot part of the pipeline are planning to move the region’s gas supplies to Greece, and from there on to Europe, with the construction of a stop-start pipeline project. The pipeline currently planned is not economically and technically feasible. Two other important issues are whether or not the amount of gas available in the region is sufficient to meet the needs of the European Union or other customers in the region, as well as the likelihood of continued or non-sustained demand for future energy resources in the region

The discovery of oil and gas in the Mediterranean and especially around the island of Cyprus and the discovery of new resources in special economic zones can play a special role in the energy security of neighboring countries.

Currently, major energy companies around the world, such as ExxonMobil America, Nobel, Shell France, Annie Italy, Qatar Petroleum, South Korea’s Kogas, Israel Delta, etc., are active in the region. Meanwhile, U.S., Russian and other naval vessels are also present in the region.

The presence of numerous naval vessels cannot be solely due to the Mediterranean’s energy resources. In this geographical area, it seems that the balance of power is as important as the energy resources of the great powers, and on this basis, this region has become a new stage of competition for those powers.

Moscow on alert

The Syrian crisis has made the region’s energy resources more and more attractive to large energy companies and governments. Moreover, Russia is concerned about the increased U.S. presence in the region.

In December last year, Russian Foreign Ministry spokeswoman Maria Zakharova issued a statement expressing Moscow’s concern over the presence of U.S. troops in the region, particularly Cyprus. She warned that the U.S. military presence in Cyprus would lead to a confrontation with Russia.

According to him, intelligence sources say the U.S. is stepping up efforts to increase its military presence in Cyprus to curb Russian influence in the region. Russia, one of the largest energy exporters in the world with huge reserves of natural gas, wants to strengthen its position in the energy equations in the Eastern Mediterranean.

Rivalry over EU

Russia is by no means willing to reduce its share of the European gas market. If conditions for exporting Mediterranean gas resources to the EU market were met, it would mean a decline in Russia’s share of the EU gas market in the coming years. For this reason, Russia is carefully monitoring developments in the region.

The presence of the Russian fleet in the region and numerous visits by Russian officials to those areas indicate Russia’s plan to play an active role in the region’s energy equations. Russia’s support for the Assad regime could also be seen as part of Moscow’s active diplomacy in the region.

The European Union’s energy market has always been a U.S. target. Reducing Europe’s dependence on Russian gas and increasing liquefied natural gas (LNG) imports from the United States are among the important goals that play an active role in U.S. energy diplomacy with the European Union. It would not be good news for the United States if the Mediterranean Sea were to provide Europe with energy resources.

U.S. support for its allies in the region is another factor for the U.S. military presence in those areas. In recent months, as the Turkish drilling activity on the Mediterranean coast has increased, the U.S. has officially expressed concern about the operation.

Last May, the U.S. State Department issued a statement urging Turkey to reconsider its decision to drill offshore of Cyprus. The U.S. said in a statement that such actions exacerbated regional tensions and called on Turkey to halt drilling operations.

With the discovery of gas resources off the Greek coast of Cyprus, disputes between Turkey, Cyprus and Greece have increased. Turkey believes that the gas resources off the coast of both parts of Cyprus belong to all residents of the island and should be shared between the two sides.

Energy resources in the Eastern Mediterranean can also be used to ensure energy security and reduce its dependence on foreign resources, as well as to ease tensions between coastal states. Unless the problems and disputes of coastal states are manipulated to exploit these resources, the likelihood of tension between them will increase.

In this context, if the Mediterranean’s energy resources cannot be transferred to the regional consumption market, it would mean maintaining the U.S. and Russia’s share of the global gas market.

The Financial Times in an article proposes alternatives to the transfer of gas to the occupied territories. The report emphasized that the least expensive option is gas transportation through Turkey, but there are numerous differences between the two sides. In addition, rivalry between the Arab countries and Israel also blocks the pipeline from the occupied territories to the regional waters of Lebanon and Syria.

Egypt does not face such problems. It has two liquefied natural gas stations and can easily transfer gas to Europe and Asia via the Suez Canal. Egypt seems to be taking advantage of this opportunity in an appropriate way.

Egyptian Minister of Petroleum and Mineral Resources Tariq al-Mulla said in February 2018: “We are looking to turn Egypt into a logical center for gas and oil trade and transportation as a strategic regional hub for energy through its energy production and imports.”

It is working with neighboring governments to meet some of the needs of the domestic market and also meet the basic needs of other countries. A report from the European Parliament in 2017 stressed that Egypt appears to hold the key to the future of Eastern Mediterranean gas.

European demands

There is also increasing European demand. Currently, the world is moving towards safer energy sources with lower emissions. From this perspective, natural gas is more attractive than oil, in addition the natural gas fields discovered in the eastern Mediterranean Sea are a strategic opportunity for Europe, as North Mediterranean reserves are declining, and Europe’s dependence is on Russian gas. This has also been a tool of pressure to threaten Europe’s energy security.

Economic crises are also an issue. Most countries in the eastern Mediterranean region are suffering from economic crises, including the increase in the country’s debt to GDP ratio. Turkey and Cyprus suffer from a decline and Israel suffers from a shortage of energy, food and water resources, which has always made it a necessity for neighboring countries to meet their basic needs.

Natural gas reserves in the economic and water zones of these countries serve as a means of meeting domestic demand for energy resources as well as a major source of imports of foreign goods and currencies. In addition, it can be used as a tool to attract foreign direct investment and create new job opportunities. Overall, these natural resources are somewhat reliable for resolving economic crises and influencing the development process of these countries.

Gas competition in the Eastern Mediterranean region creates many possibilities.

Turkey seeks to create new alliances with countries that have not previously had specific alliances, including Lebanon, Syria, and the Palestinian Authority (PA). This is followed by two goals.

First, to obtain a share of gas to meet domestic needs, and second, to work with these countries to build a gas pipeline to world markets. Lebanon has begun work on exploring gas resources but has not yet entered into a coalition to guarantee exports of its future products. Syria also faces turmoil in the current situation as companies refuse exploration activities as a result of these developments.

Large quantities of natural gas are expected to be discovered in Syrian regional waters. Many analysts believe that Turkey’s entry into the Syrian conflict has been in line with its desire to supply its own materials, especially gas needs. The Palestinian Authority has the right to use the gas fields located near the Gaza Strip, but the conditions of occupation and internal divisions within Palestinian groups preclude serious action.

The Eastern Mediterranean is a region where military activity has increased in the recent period. Because of the Syrian issue, countries such as the Russian Federation, the United States, Great Britain and France have an important naval force in this region.

Cyprus seeks to turn its natural gas resources into economic wealth in the next 10 years. Stating that the Turkish side will benefit from the income to be obtained and a fund will be created for this, the Cyprus government aims to ease the pressure from the international community, especially the U.N. In Greece, which went to early elections on July 7, power changed, the radical left coalition (Alexis Tsipras finished second) and the New Democracy Party came to power alone.

How did energy tension change the regional equation? The discovery of hydrocarbon reserves in the eastern Mediterranean has led to new areas of cooperation and alliances among riparian countries. These countries united in the aim of extracting the natural gas reserves that Israel found in Tamar and Leviathan, Egypt’s Zohr and Cyprus’ Aphrodite deposits and transporting them to the European market through pipelines, and started to create new regional cooperation platforms with the participation of Greece.

The Cairo gathering

Meeting in Cairo in January, Cyprus, Greece, Israel, Italy, Jordan, Palestine and Egypt announced the establishment of the eastern Mediterranean Gas Forum to cooperate in the production, consumption and marketing of regional resources and to transform the eastern Mediterranean into a new energy base.

In parallel to this process, Cyprus, together with Greece, Egypt, Israel and Jordan established separate trilateral cooperation formations, while both the U.S. and the EU have received strong support.

At the end of the drilling in the last 10 years, Israel has announced that it has found 320 billion cubic meters in the Tamar bed, 600 billion cubic meters in Leviathan, 130 billion cubic meters in Aphrodite and 200 billion cubic meters in Calypso. The region’s largest source of natural gas was the Zohr region of Egypt, with 800 billion cubic meters of reserves.

However, since the amount of natural gas found is very small on a global scale, it raises questions about how to operate and market its resources. It is estimated that the cost of building an LNG terminal in Cyprus will be 5 billion euros ($5.55 billion) and that the Cyprus-Greece-Italy gas line will be built at a cost of 6 billion euros. When the account cannot be made for political reasons, a gas pipeline via Turkey would be most appropriate to use the current LNG export terminal in Egypt.