Iran announced this week that it exported $26.5 billion of oil during the past 9 months, a figure that contradicts both previous Iranian and international estimates.

For years, Iranian administrations have not transparently disclosed their oil revenues, citing the illicit nature of shipments under the US sanctions regime. However, in the past two months, the Raisi government has released some statistics on oil revenues, labeling it the ‘transparency of the Raisi administration.

Mohammad Rezvani-Far, the Head of Iran Customs Administration (IRICA), stated on December 27, that during the first 9 months of current Iranian fiscal year, the country’s oil exports totaled $26.46 billion, electricity exports were $300 million, and technical and engineering services exports were approximately $780 million.

He referred to the total foreign trade of the country during this period as $112 billion, stating that $63 billions of this amount is related to the total exports of the country, including oil, electricity, and services.

At the same time, Ehsan Khandouzi, the Minister of Economic Affairs and Finance, also confirmed these figures.

Confirmation comes while the figures presented by Minster Khandouzi and the Head of the Central Bank of Iran last month indicated that the total exports of oil, electricity, and services of the country in the first 8 months of the current fiscal year (March 2023 to November 2023) were about $20 billion.

From the official statements of the Raisi administration, it is understood that the average monthly exports of oil, electricity, and services in the first 8 months were $2.5 billion, but suddenly in the 9th month of the Iranian calendar, it surged to over $7.5 billion.

Statistics from industry monitoring firm Kpler show that the volume of Iran’s oil exports in the past month not only did not grow compared to previous months but it showed a notable decrease.

Also, tanker tracking companies’ statistics show that Iran exports 1.25 million barrels per day of crude oil and gas condensate as well as more than 200 thousand barrels of petroleum products (mazut and kerosene) during the current fiscal year.

The nominal price of Iranian oil is between $80-$85 according to OPEC statistics. Thus, Iran’s oil export revenues should have been about $34 billion in the nine-month perios, but the statements of the Head of Customs and the Minister of Economy indicate that this figure is $26.46 billion.

The reason for this lies in Iran’s extensive discounts to Chinese oil refineries and the cost of circumventing sanctions, especially middlemen, who arrange the illicit Iranian shipments to China by various methods, including mixing Iranian crude with shipments from other countries, thus hiding their origin.

Iran also barters some of its oil with Chinese goods. However, this amount is included in the country’s oil export figures.

The Customs statistics in China show that from April to November (approximately the first 9 months of the Iranian calendar year), China imported about $2.6 billion of non-oil goods and $5.5 billion of exports to Iran. Thus, about $3 billion of Iran’s oil exports to China during this period were spent on bartering with Chinese goods.

In the process of bartering oil with goods, a significant part of the value of Iran’s oil is wasted due to the costs of dealers and intermediaries.

Service Exports And The Country’s Trade Balance

UN statistics show that in 2017, before the US imposed sanctions, Iran had nearly $10 billion in annual service exports, the majority of which was transportation, personal travel, construction services as well as business travel. Iran’s service imports were $17 billion as well.

The latest statistics from the Iran Trade Development Organization show that the country’s service exports reached just $2.3 billion in 2021, and some scattered statements by Iranian officials indicate that this figure was about $4 billion last year. Now, the statements of the head of Iran Customs show that in the first 9 months of this year, this figure has dropped to $780 million. He did not explain why the country’s export of services suddenly plummeted.

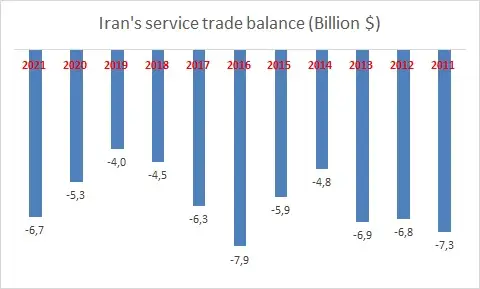

The Central Bank of Iran does not separately publish statistics on the export and import of services, but it publishes the statistics of the trade balance of services (the difference between service exports and imports), which has always been around negative five to six billion dollars in recent years.

The head of customs and the minister of economy, without mentioning the existence of the annual negative balance of five to six billion dollars for services, only referred to the statistics of service exports, oil, and non-oil goods and claimed that during the 9 months, the total foreign trade balance of the country was a positive $15 billion.

In other words, in the calculations of these senior officials, Iran had a total of $63 billion in oil, non-oil, and service exports during this period, but only imported $49 billion in goods. The figures presented by the two senior officials of Ebrahim Raisi administration only include the import of goods and do not include petroleum products imports (gasoline), as well as service imports, and it cannot be claimed that the foreign trade balance was a positive $15 billion during this period.

Capital Flight

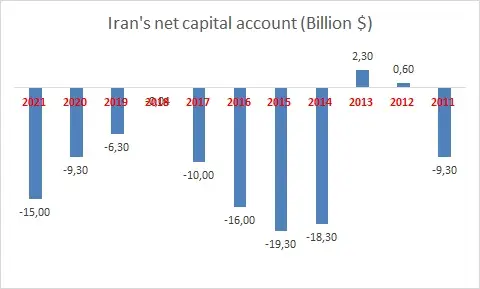

Central Bank statistics show that, considering oil, non-oil and service trade, Iran’s net capital account was a negative $15 billion last Iranian year (March 2022-March 2023). In other words, the outflow of foreign currencies from the country was $15 billion more than the inflow of foreign currencies.

Central Bank statistics show that the country had about $100 billion negative capital account during 2011-2021.

Part of this situation is due to the large gap in the balance of trade in services, but a significant part of it is also due to the efforts of the people to take their capital out of Iran and buy property in foreign countries, especially Turkey, the Emirates, and Western countries.

Reports from the Turkish Statistical Institute show that in recent years, Iranian have been the top buyers of homes in this country. Since the US imposed sanctions against Iran in 2018, Iranians have purchased about 39,000 homes in Turkey.

The purchase of houses and properties is just one facet of capital flight from Iran. Owing to the unfavorable economic prospects within the country, Iranian citizens have embarked on substantial capital investments, diversifying into various forms of real estate and assets abroad.