As Iran grapples with a severe lack of foreign investment, its Arab neighbors are increasingly channeling funds into Iran’s northern regions, boosting trade turnover.

On December 17, the United Arab Emirates and the Republic of Azerbaijan jointly launched a substantial investment fund worth one billion dollars. This collaborative venture sees the Azerbaijan Investment Holding and the Abu Dhabi Investment Company each holding a 50% stake in the fund. The primary focus of their investments will revolve around clean energy, agriculture, pharmaceuticals, and technology, encompassing Azerbaijan, the UAE, and Central Asia.

In recent years, Gulf Cooperation Council (GCC) members, particularly Saudi Arabia and the United Arab Emirates, have signed investment agreements totaling nearly $30 billion with the Republic of Azerbaijan and four Turkic-speaking Central Asian nations, including Turkmenistan, Uzbekistan, Kazakhstan, and Kyrgyzstan. These agreements have significantly bolstered trade relations between the Arab states and these countries, with a notable emphasis on non-oil products and substantial investments directed toward clean energy initiatives.

GCC And Azerbaijan

Emirates-based company “Masdar” unveiled a $262 million, 230-megawatt solar power plant in the Republic of Azerbaijan just two months ago. Simultaneously, Masdar signed contracts for the construction of three solar and wind power firms, boasting a combined capacity of one gigawatt, all within Azerbaijan.

Joining the renewable energy endeavors in Azerbaijan, French Total and British BP, along with Saudi’s “Acwa Power,” are currently investing $290 million to establish a 230-megawatt wind power plant. Furthermore, these companies inked two significant agreements this spring to generate 2,500 megawatts of wind and solar power, both on land and at sea, in collaboration with the Republic of Azerbaijan.

All these investments take place as Iran suffers from energy shortages and its renewable energy sector remains seriously under-developed.

Azerbaijan’s contracts with Total and Acwa Power also include large electricity storage facilities, allowing the country to save and provide a significant amount of electricity for sale at much higher prices to foreign customers during peak consumption periods.

Azerbaijan has adopted a similar approach in its natural gas trade strategy. The nation has developed underground gas storage facilities and expanded its gas storage capacity to 3.5 billion cubic meters. During the summer, Azerbaijan injects surplus gas from Turkmenistan, received through Iran, into these storage facilities. Then, during the winter months, it re-extracts and exports this gas at considerably higher prices.

Abu Dhabi National Oil Company (ADNOC) has also entered the Azerbaijani energy sector by acquiring a 30% stake in the Absheron gas field, located in the Caspian Sea’s Azerbaijani sector. While the first phase of this gas field, operated by Total, commenced operations this year, the second phase is scheduled to be operational by 2027. Upon full operation, the gas field will annually produce six billion cubic meters of gas destined for European markets.

Baku has ambitious plans to double its natural gas exports to Europe within the next three years. In a recent development, the country initiated gas sales to its seventh customer, Serbia. Currently, Georgia, Turkey, Greece, Italy, Romania, Bulgaria, and Serbia are all recipients of Azerbaijani gas, collectively importing 22 billion cubic meters of gas from Azerbaijan in the first 11 months of this year.

The revenue from Azerbaijani gas exports surpassed that of oil exports for the first time last year. The nation also has its sights set on substantial growth in electricity exports.

Azerbaijan aims to launch approximately 10,000 megawatts of renewable power plants by 2030, equivalent to ten times the electricity generation capacity of Iran’s Bushehr nuclear power plant. A significant portion of this electricity will be exported to Europe. Notably, last year, Azerbaijan exported over three terawatt-hours of electricity, three times more than Iran’s net electricity exports. A massive undersea cable installation project is underway, spanning 1,100 kilometers across the Black Sea from Georgia to the Baltic region. This initiative marks the beginning of Azerbaijan’s electricity exports to Europe via Georgia.

Trade relations between the Republic of Azerbaijan and Saudi Arabia, as well as the United Arab Emirates, have experienced a fivefold and 2.5-fold increase, respectively, over the past three years. Importantly, a substantial portion of this trade involves non-oil commodities.

GCC And Central Asia

In the broader context of the Gulf Cooperation Council (GCC) and Central Asia, the United Arab Emirates and Saudi Arabia have collectively signed investment agreements exceeding $20 billion with four Turkic-speaking Central Asian countries, including Turkmenistan, Uzbekistan, Kazakhstan, and Kyrgyzstan. Additionally, Qatar and Oman have recently penned new investment memoranda with these nations.

The vast assets of GCC investment funds and national wealth, amounting to a staggering $4 trillion, have enabled these countries to embark on the establishment of innovative indigenous companies. This has facilitated the integration of modern Western technologies, leading to a significant influx of foreign projects.

For years, the UAE’s Dragon Oil has held the exclusive development rights for Turkmenistan offshore oil and gas fields, exporting the produced oil to European markets through the Republic of Azerbaijan. Last year, the company signed a new billion-dollar contract with Turkmenistan and committed to investing $8 billion in new oil and gas fields over the next 15 years.

The UAE has invested seven billion dollars in Kazakhstan and Uzbekistan, part of which involves the development of a thousand megawatts of solar and wind power plants by the UAE’s Masdar company. Qatar also signed a joint investment fund with an initial asset of $100 million, along with a commitment to invest in projects worth $1.2 billion in Kyrgyzstan.

The UAE also holds a 51-percent share in the Khorgos Customs in Kazakhstan in collaboration with China, and a 49% share in the Aktau Seaport in the Caspian Sea. Additionally, Saudi Arabia’s Acwa Power has signed contracts worth $13.5 billion with Kazakhstan and Uzbekistan for the development of clean energy, including solar and wind, converting fossil fuels into clean hydrogen, and more.

During a meeting held in June that brought together leaders from the GCC and Central Asian countries, the Abu Dhabi National Energy Company announced a $3 billion investment agreement with Uzbekistan, focused on thermal power plants. In the same gathering, Qatar also committed to a $12 billion investment in Uzbekistan.

As these developments unfold, Oman and Kuwait are engaged in preliminary agreements for new investments in Central Asian nations. Currently, Oman holds a 20% stake in the Zhemchuzhina and Dunga oil fields located in Kazakhstan.

Iran, Northern Neighbors Relations

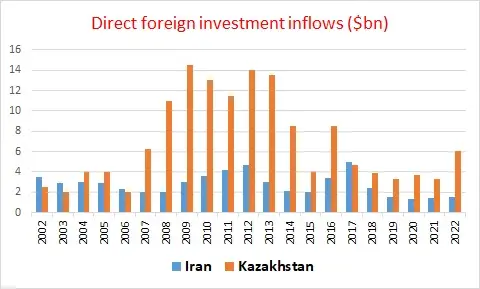

In contrast, Iran’s financial relations with its northern neighbors revolve solely around trade, without the inclusion of joint investment projects, investment funds, and similar endeavors. This limitation is primarily attributed to political tensions between Iran and its neighboring states, as well as the impact of international sanctions.

In contrast, Iran’s financial relations with its northern neighbors revolve solely around trade, without the inclusion of joint investment projects, investment funds, and similar endeavors. This limitation is primarily attributed to political tensions between Iran and its neighboring states, as well as the impact of international sanctions.

However, when it comes to Central Asia and the Caucasus, these eight countries collectively account for less than 4% of Iran’s foreign trade. Despite shared religious, cultural, and linguistic ties, the intricate nature of Iran’s economic relationship with these nations becomes evident.

In 2022, Iran’s trade volume with Central Asian countries demonstrated significant growth, though it still comprised less than 2% of the nation’s total foreign trade. Trade with Kyrgyzstan and Tajikistan, for instance, reached approximately $170 million. Furthermore, the trade volume between Kazakhstan and Iran witnessed a 20% increase compared to the previous year, totaling $528 million.

Iran currently occupies a limited geopolitical position in Central Asia, despite its advantageous geographic location and long-standing historical connections with the region. The rising investments from Saudi Arabia, the United Arab Emirates, and other Gulf Cooperation Council (GCC) countries further complicate the existing intricate dynamics. To remain relevant and assert its influence in Central Asia, Iran must recalibrate its regional policy, addressing diplomatic tensions, particularly with neighbors like Azerbaijan, and nurturing an environment conducive to enhanced economic collaboration. A proactive approach, involving the strengthening of economic ties, leveraging cultural affinities, and engaging in constructive dialogues, will be essential for Iran’s continued significance amid the evolving dynamics of the region.

www.iranintl.com