The Gaza-Israel conflict has significant implications for Iran’s already strained economy, characterized by currency devaluation, reduced government revenues, and high inflation.

Iran’s involvement in the regional conflict hinders its economic growth efforts, further reduces the value of the Iranian rial, and decreases government income. Additionally, it has worsened economic problems such as inflation, diminishing oil exports, and weaker GDP growth.

The falling value of the rial is the direct result of fears about a wider war involving Iran. Domestic investors hedge their bets by buying US dollars and other currencies, part of which is sent abroad, exacerbating an already high rate of capital flight.

On February 15th, the Institute of International Finance (IIF) released a report on the Global Economic Fallout of a Regional War. According to the report, a pessimistic scenario could lead to a 0.4 percentage point decrease in global growth compared to the baseline scenario in 2024, resulting in a 2.4% global growth rate.

In this pessimistic scenario, the Middle East faces dire consequences, including potential disruptions to oil production, tight monetary policies in GCC countries, and damage to infrastructure in Lebanon and Israel. Egypt’s economy could suffer from decreased cargo passing through the Suez Canal. Iran’s economy may contract by around 5%, with inflation exceeding 100%.

Despite Iranian officials’ repeated statements about staying out of a larger regional conflict, its proxy armed groups continue provocations that could lead to a direct confrontation with Israel and/or the United States. This could cause disruptions in shipping in the Strait of Hormuz, affecting oil flow.

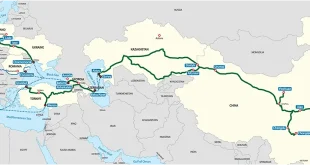

The Gaza conflict significantly affects the global logistics and supply chain industry, particularly in the Middle East, raising concerns about shipping bottlenecks, increased freight rates, and erratic delivery schedules, disrupting the flow of goods and materials.

Iran’s involvement in the Gaza crisis has significant economic implications. It may stir up nationalist sentiments at home and divert attention from its own economic challenges by supporting organizations like Hamas in Gaza. Furthermore, the conflict between Israel and Gaza not only has an immediate impact on the local economy but also has the potential to reshape the Middle East and North Africa region, affecting travel, commerce, investment, and energy sectors.

The International Monetary Fund (IMF) has underscored the adverse economic impact of Iran’s participation in the Gaza conflict on local and regional businesses.

The Houthi’s miscalculation that attacks on ships in the Bab-el-Mandeb strait and the Red Sea would go unpunished was debunked as the US and UK intervened, targeting Houthi positions. According to the IMF, the cost of shipping products from Asia to Europe, bypassing the Suez Canal due to Houthi strikes, has doubled.

Iran Economy

Iran’s economy has significantly deteriorated over the past decade due to sanctions, corruption, and inefficiency, contrasting with the growth of other regional economies.

According to the IMF, if the destabilizing activities of Iran’s proxies persist, it could result in significant damage to the global economy, with Lebanon and Iran bearing the brunt of the impact.

The attacks by Iran-backed Houthi militants, along with controlled strikes by international coalition forces against their positions, has already caused Yemen’s economy to contract by 1.2% last year, with further decline expected this year.

The IMF cautions that if the Gaza conflict escalates, Yemen’s economy could shrink by up to 8% in 2024, while Iran and Lebanon might face GDP declines of 5% and 20%, respectively.

Furthermore, the potential for trade disruptions in the Strait of Hormuz looms if Iran becomes directly involved in the Gaza conflict. A significant portion of the world’s liquefied gas (13%) and oil (35%) exports pass through this crucial waterway, with potential global energy price spikes.

Even if Iran were to temporarily succeed in blocking the Strait of Hormuz, it would ultimately harm itself. Notably, these southern waterways serve also as a major transit route for Iran’s non-oil imports and exports.

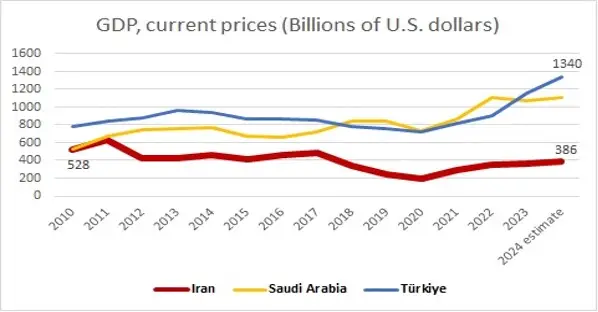

Referring to IMF data, it’s important to highlight that Iran’s GDP has dropped by 40% from 2010 to the present day, whereas both Turkey and Saudi Arabia currently have GDPs that are more than three times larger than Iran’s.

According to the Institute of International Finance (IIF)‘s pessimistic scenario, there could be a contraction of 0.4 percentage points in global growth compared to the baseline scenario in 2024. This decline is primarily attributed to the heightened probability of disruptions in shipping routes via the Strait of Hormuz and the Suez Canal, particularly if Iran or its allies interfere with oil exports through the latter.