Iranian-Chinese economic relations have grown steadily closer over the past four decades, with Beijing emerging as one of Tehran’s leading trade partners in recent years. Their economic relationship entered a new phase in the 1980s, when China started providing Iran with arms and technology during the Iran-Iraq War. But since then, trade extended to various other key economic sectors, consisting mainly of heavy machinery, electronics, consumer goods, and energy resources. Today, China is one of Iran’s most important destination markets and a leading source of imports: Chinese customs data shows that the trade volume with Iran in 2022 reached $15.795 billion, $1.035 billion higher than the figure recorded in 2021. China’s exports to Iran in this period grew by 14%, reaching $9.44 billion, as opposed to $8.258 billion in 2021. Although, in contrast, the value of Iran’s non-oil exports to China decreased by 2% in 2022, amounting to $6.355 billion, compared to $6.502 billion in 2021.

Bloomberg reports that despite U.S. sanctions, Iranian oil exports have significantly increased in recent years, to around 1 million barrels of oil per day and exceeded 1.5 million barrels in May, with a sizable percentage of this production going to China. The growth in Chinese demand comes down to a number of factors, including the Iranian oil’s favorable price, political considerations of building strategic global alliances in opposition to the U.S., and China’s critical need to safeguard its energy supplies. Beijing’s role as a vital consumer has facilitated a comeback for Iranian petroleum on the international market.

Yet despite this clear growth in trade, especially when it comes to Chinese exports to Iran and purchases of Iranian oil, the same cannot be said for China’s investments in the Iranian economy, which have remained anemic, particularly in the critical energy sector. This has raised related questions about the nature of the broader Chinese-Iranian relationship and whether or not it can truly be considered “strategic.”

China “goes out” but bypasses Iran

China’s “Going Out Policy,” introduced by the government in 1999 to encourage Chinese companies to look for strategic business opportunities abroad, has influenced the country’s investment decisions across Asia and beyond. Its main objective is to support the internationalization of Chinese enterprises, bolster their competitiveness, and increase their global market share. From a practical standpoint, the policy encourages Chinese companies to invest overseas, acquire foreign firms, and establish joint ventures with foreign partners. And although Iran has significant potential for this type of investment, Chinese money has mostly shied away from the Iranian market so far — especially in the energy sector.

Iran boasts some of the world’s largest reserves of oil and natural gas, while China is a top global importer of these commodities. Despite severe sanctions imposed by the United States, China’s demand for Iranian oil has increased since 2018, enabling Iran to keep exporting oil to China — a critical means for sustaining Iran’s economic stability. Yet while the hydrocarbon sector is a significant driver of the bilateral trade relationship, this has yet to translate into Chinese direct investment.

Iran and China’s economic cooperation has faced several challenges, including international sanctions imposed on Iran by Western countries, the lack of a clear legal framework for economic cooperation, poor infrastructure in Iran, and a lack of anti-money laundering and counter-terrorism funding certification of Iran’s energy sector by the Financial Action Task Force (FATF). These factors have made it difficult for companies in both countries to engage in meaningful economic cooperation, creating uncertainty for investors and limiting opportunities for growth.

FATF certification is an important prerequisite to diversifying sources of capital for Iran’s oil and gas industries and diversifying international economic partnerships in this sector. Such diversification would not only bolster Iran’s resilience to market changes but also encourage greater domestic industrial competitiveness and innovation.

Iran “looks East”

In recent years, in part to counter the economic sanctions imposed by the U.S., Iran has prioritized its foreign policy toward the East, principally Russia and China. Notably, the 25-year, $400 billion comprehensive cooperation agreement with China, which the two countries signed in March 2021, serves as a blueprint and vision for bilateral collaboration in areas such as oil, gas, petrochemicals, renewable energy, nuclear power, tourism, transit, trade, and railways. Nonetheless, this approach has thus far not resulted in a significant increase in Chinese investment in Iran. Furthermore, the agreement aligns with Beijing’s Belt and Road Initiative (BRI), which involves investing billions of dollars in infrastructure; China has repeatedly been accused of using the BRI to establish long-term influence and economic and security dominance over participating countries. So although Iranian officials have emphasized the importance of their relationship with Beijing, many Iranians are skeptical about the strategic nature of this partnership. Notably, the media in Iran repeatedly voiced criticism after President Ebrahim Raisi’s Feb. 14, 2023, summit in China. And Iranian international relations scholar Hassan Beheshtipour has pointed to Beijing’s stance on the Emirati-Iranian dispute over three islands in the Gulf as evidence that Iran’s relationship with China cannot be considered truly strategic or based on unqualified trust.

Raisi’s recent travel to China marked the first such visit by an Iranian president in 20 years. The trip had a particular focus on strengthening economic ties, especially in the energy sector. It is worth pointing out that the visit took place a little over a year after Iranian Foreign Minister Hossein Amir-Abdollahian announced that the above-mentioned 25-year comprehensive cooperation agreement with China had reached the implementation stage.

But 18 months on from Amir-Abdollahian’s assertion about progress in the economic relationship, Beijing has yet to make any significant new investments in Iran, notably in the energy sector. The successful implementation of this comprehensive cooperation document would require careful, detailed, and pragmatic planning over the long term. During Raisi’s visit to Beijing, the two sides announced the signing of 20 memoranda of understanding (MoUs) and cooperation documents. Additionally, Iranian media touted the continued development of oil fields by Chinese companies as among the “most important achievements” of Raisi’s trip. The message was undermined, however, by the revelation that same month that Sinopec, the last Chinese oil company operating in Iran, was exiting the country.

China’s limited investment interest in Iran contrasts sharply with many of Iran’s regional neighbors. According to the Washington, D.C.-based American Enterprise Institute’s “China Global Investment Tracker,” China invested $618 million in projects in Iran from 2018 to 2022, mainly in the construction sector. This four-year period notably began with the Trump administration’s implementation of its “maximum pressure campaign” of sanctions against Iran. Meanwhile, China invested $22.5 billion in Saudi Arabia, $13 billion in Iraq, $4.6 billion in Kuwait, $1.8 billion in Qatar, $19.3 billion in the United Arab Emirates, and $2.5 billion in Oman. Even China’s investment in Bahrain was more than twice that of Iran. In total, Chinese capital invested in Arab countries in the Persian Gulf was almost 72 times that of Iran from 2018 to 2022.

While the factors contributing to the slow pace of Iranian-Chinese economic cooperation are complex, sanctions have been the primary reason. After the U.S. withdrawal from the 2015 Iran nuclear deal and the reimposition of severe sanctions in 2018, Tehran resorted to selling oil to Beijing on the gray market to evade sanctions and mitigate the impact on its economy. By May 2019, however, Iran had exhausted all its options and resources to sell oil through these channels. In April 2022, Javad Owji, Iran’s oil minister, stated that the country required $80 billion in investment in the gas sector to meet its production goal of 1.4 billion cubic meters per day, without which, he added, Iran would be forced to start importing this energy source.

Opportunities amid a regional geopolitical shift

Despite these challenges, there are at least some reasons to be optimistic about the future of economic cooperation between Iran and China. According to Bloomberg, Chinese private refineries, also known as teapots, are boosting their purchases of Iranian oil due to rising international competition for initially under-priced supplies from Russia (devalued as a result of Western purchase bans). Thus, in March, imports of Iranian crude and condensate by China increased by 20% compared to the previous month, reaching 800,000 barrels per day.

For now, China most critically relies on the safety of oil and liquefied natural gas transport from the Persian Gulf and the Strait of Hormuz to maintain its energy supply. Houthi attacks on Saudi Aramco’s oil facilities in 2019, likely using Iranian-supplied drones, threatened China’s energy security and that of other major energy consumers. So as part of its efforts to ensure the security of Arab hydrocarbon-producing countries in the region, China has invested heavily in their energy infrastructure and military industries. This has led to increased military cooperation with Saudi Arabia. In turn, Aramco has invested in China’s energy infrastructure, further strengthening Chinese-Saudi ties. Beijing’s interest in improving relations between Iran and Saudi Arabia has been motivated by these developments.

If the spring 2023 Iran-Saudi Arabia normalization agreement is fully and extensively implemented, it might also have a substantial impact on China’s economic relationship with Iran, including in the investment space. Namely, Chinese investors may become more involved in Iran’s oil and gas sector, infrastructure projects, and other major industries, if regional geopolitical risks can be significantly reduced through the repair of diplomatic relations between Tehran and Riyadh.

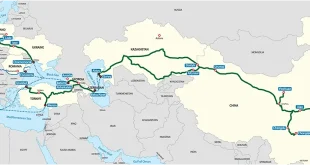

Meanwhile, there has been some movement on developing overland transit links that will cross Iran. During Chinese President Xi Jinping’s visit to Iran in January 2016, he expressed a desire to see long-term peace and stability in the Middle East as well as to aid Iran. Xi echoed these same sentiments during his visit to Tehran in 2022. His emphasis on supporting Iran and fostering regional cooperation alluded to China’s dedication to efforts that improve regional connectivity and economic linkages, for which the development of trans- and intra-regional railway networks can serve as a beneficial catalyst. Thus, in June 2022, the first cargo train from China to Tehran, via Kazakhstan and the Caspian Sea, successfully arrived. And days earlier, the inaugural container train traveling along the recently established Kazakhstan-Turkmenistan-Iran-Turkey (KTIT) railway also pulled into the station at the Iranian capital. The KTIT railway, part of the so-called Middle Corridor, may eventually become a durable link in east-west multimodal transit between Asia and Europe.

Iran’s Oil Minister Owji has suggested that an additional investment of approximately $160 billion is required for the country’s oil and gas industry, indicating significant potential for growth. But the high level of risk Iran poses for foreign investors creates significant obstacles. Additionally, Chinese companies already compete with Iranian businesses in several sectors, hampering Iran’s ability to gain greater access to China’s market. To overcome these challenges, Iranian businesses must improve their marketing strategies and product quality, while also enhancing domestic infrastructure networks and exploring new trade opportunities. Additionally, both sides will need to better adapt to each other’s business practices and improve bilateral dialogue. A successful long-term economic partnership between Iran and China would not only benefit both countries but also promote greater regional stability as well as reshape the global economic order by enhancing connectivity and trade along BRI-linked transit corridors, thus increasing Beijing’s influence.

Conclusion

To strengthen their geopolitical ties, Iran and China will need to deepen joint economic cooperation and improve bilateral communication channels, but at the same time both sides will have to exercise caution and foresight to ensure long-term sustainability and address potential concerns regarding regional stability and security. Given China’s diversification policy, Iran has significant potential to contribute to Chinese energy security. However, under the current international sanctions regime, China cannot invest in Iran’s oil and gas sector.

Beijing’s overarching strategic interest is in preserving regional stability and security so as to avoid serious disruptions to its energy supply; consequently, China’s relations with Arab countries, such as Saudi Arabia, have so far tended to take priority. Beijing can be expected to continue to try to use its influence with Tehran to discourage the latter from targeting Arab states’ energy infrastructure or disrupting the security of energy supply in the region through proxy groups. For Iran to benefit from the financial resources and technological know-how of Chinese companies, it needs to review its foreign and defense policies, including its missile, nuclear, and drone programs. By adopting a de-escalatory foreign policy and living up to the FATF’s anti-money laundering and terrorism financing requirements, Iran could substantially increase its trade volume with China in the future, after sanctions are lifted.