Iran has significantly increased the consumption of Mazut, a dirty fuel, in cement factories, despite widespread warnings and criticisms of its use in power plants.

Ali-Akbar Alvandian, the secretary of the Association of Employers of the Cement Industry in Iran, has reported a several-fold increase in Mazut consumption in cement factories.

Alvandian informed ILNA news agency on January 12 that the gas consumption of the country’s cement factories has decreased to 6 million cubic meters per day in winter, while their usual daily consumption stands at 27 million cubic meters. He revealed that 70% of the country’s cement production now relies on Mazut fuel.

Iran faces a significant natural gas shortage during the winter, leading to the utilization of the highly polluting Mazut as an alternative fuel. While one liter of Mazut can replace one cubic meter of gas, its pollution levels are substantially higher than those of natural gas.

According to the Environment Agency of the German government as well as US Environmental Protection Agency (EPA), the direct CO2 emissions of Mazut (fuel oil) are 33% higher than natural gas. Iran’s Mazut also contains 3.5% sulfur, which is approximately seven times higher than the required standards for ship fuel, making it far more pollutant than natural gas.

Alvandian continued, mentioning that factories located away from urban areas use Mazut as an alternative fuel, but factories near cities have excluded furnaces have reduced its use.

He further disclosed that, on a general scale, 70 percent of the country’s cement production now relies on Mazut fuel. Given the daily gas requirement of 27 million cubic meters for cement factories across the country, the current delivery of six million cubic meters per day combined with the production of 70 percent of the country’s cement using Mazut, indicates that approximately 13 million liters of Mazut are used daily in Iran’s cement production.

A document from the National Iranian Gas Company (NIGC), obtained by Iran International, reveals that Iran uses Mazut in cement factories even during the warm seasons. According to this document, the average gas delivery to cement factories during the summer was around 20 million liters per day, indicating that the sector used roughly 7 million liters of Mazut daily at full capacity.

Iran is currently grappling with a gas shortage not only in the cold seasons but also in spring and summer, leading to the utilization of Mazut as a fuel source.

Another document from the Ministry of Oil illustrates that Iran consumed 19 million liters of Mazut daily in industries and power plants during the spring and summer of the previous year. Mazut consumption in these sectors surges to 45 million liters per day in winter, with daily diesel consumption increasing by 10 million liters from summer to winter, reaching 127 million liters. This increase is attributed to a higher substitution of diesel with natural gas in the power and industrial sectors.

Alvandian has noted that the cost of cement production with Mazut is higher than the cost of production with gas, posing a dilemma for cement factories in the eastern part of the country that have switched to Mazut. He mentioned, “Cement factories are forced to source their required Mazut from the Rey and Tehran oil storage facilities, and the cost of transporting Mazut from Tehran to the eastern provinces is added to the production cost of these units.”

Despite the country not experiencing the same level of cold as the previous year, gas consumption for domestic households remains unchanged compared to last year, making restrictions on gas supply to industries, including cement factories, inevitable, according to officials.

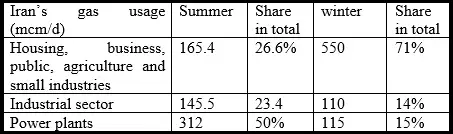

Statistics from the National Iranian Gas Company reveal that on Friday, January 12, the breakdown of gas consumption was as follows: the household sector consumed 385 million cubic meters, the transportation sector consumed 27.5 million cubic meters, the public and commercial sector consumed 60.5 million cubic meters, the agricultural sector consumed 27.5 million cubic meters, and the small industries sector consumed 60.5 million cubic meters. In total, these sectors accounted for 550 million cubic meters of gas consumption, which is 3.3 times higher than summer consumption.

The substantial increase in gas consumption in these sectors has compelled the government to significantly reduce gas supply to major industries, including cement, steel, petrochemicals, and others.

A document from the National Petrochemical Company indicates that Iran’s petrochemical production capacity was 91.5 million tons last year. However, due to gas shortages in the fall and winter, as well as power outages in the summer, only two-thirds of this capacity was operational, resulting in actual petrochemical production in the country totaling only 59.7 million tons.

In a related context, Mehdi Mahdavi Abhari, the Secretary-General of the Petrochemical Employers Association, announced last week that Iran lost $800 million in petrochemical exports due to gas supply shortages last year.

The document from the National Gas Company reveals that during the summer, nearly 70 million cubic meters of gas were supplied daily to petrochemical plants, 20 million cubic meters to cement factories, 36.5 million cubic meters to steel mills, and 17.7 million cubic meters to refineries. In total, during the summer, 145.5 million cubic meters of gas were delivered to the country’s major industries. However, on January 12 this year, this figure decreased to 110 million cubic meters.

Although Iran’s winter is still relatively mild, last year, on some days, gas consumption in the residential, commercial, and small industrial sectors in Iran had reached nearly 650 million cubic meters. This resulted in Iran facing a daily gas deficit of 250 million cubic meters last winter.