Hopes for increased economic cooperation between Iran and Saudi Arabia following last year’s diplomatic reconciliation have not materialized, due to historical and political factors Saudi Arabia and Iran have a long history of hostility, usually taking opposing sides in regional conflicts such as Yemen, Lebanon, and Syria. This competition, fueled by disruptive activities …

Read More »The Economic Fallout Of The Gaza Conflict For Iran

The Gaza-Israel conflict has significant implications for Iran’s already strained economy, characterized by currency devaluation, reduced government revenues, and high inflation. Iran’s involvement in the regional conflict hinders its economic growth efforts, further reduces the value of the Iranian rial, and decreases government income. Additionally, it has worsened economic problems such as …

Read More »Iran’s Hydrogen Fuel Production Plans Face Significant Hurdles

Iran currently lacks a substantial presence in the burgeoning hydrogen industry, despite its abundance of natural gas and renewable energy potential. Utilizing renewable energy sources such as solar or wind power, “green hydrogen“ is produced by electrolysis, which produces hydrogen without any emissions. This contrasts with traditional techniques that release carbon dioxide. Experts anticipate …

Read More »Navigating New Horizons: The Gulf’s Dynamic Energy Landscape in 2024

In 2024, the Gulf’s energy sector is poised at a critical juncture, balancing the traditional reliance on hydrocarbons with ambitious strides toward renewable energy and economic diversification amidst global economic fluctuations and regional geopolitical tensions. The Middle East played a significant role in the global energy market in 2023, navigating the delicate …

Read More »Iran Becomes A Member Of BRICS, With Hopes And Challenges

Iran officially became a member of the China-led BRICS economic organization on Monday, as it seeks to overcome the impact of US sanctions and overcome it isolation. In its policy of finding shelter under Chinese and Russian-dominated international organizations, Iran achieved full membership in the Shanghai Cooperation Organization in July 2022 and …

Read More »GCC, Iran’s Northern Neighbors Expanding Financial Ties

As Iran grapples with a severe lack of foreign investment, its Arab neighbors are increasingly channeling funds into Iran’s northern regions, boosting trade turnover. On December 17, the United Arab Emirates and the Republic of Azerbaijan jointly launched a substantial investment fund worth one billion dollars. This collaborative venture sees …

Read More »Gulf States’ Opportunities in Kazakhstan’s Emerging Economy and the Middle Corridor

As the world’s great powers and the GCC states cast their attention toward the region, the nations of Central Asia could play a major role in facilitating trade between Europe and China. When U.S. President Joe Biden and Chinese President Xi Jinping met in San Francisco to patch up Sino-American …

Read More »Ripple Effects of the Gaza War: Geopolitical Strains and Energy Market Shocks

The Gaza war has exerted significant pressure not only on the geopolitical equilibrium but have also sent ripples through global trade initiatives, energy markets, particularly affecting investment strategies and operations in the oil and gas sectors within the Mediterranean region. The ongoing Israel-Gaza war has dramatically increased geopolitical tensions across …

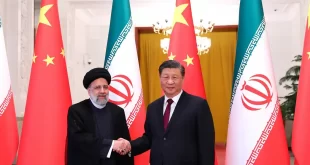

Read More »China Leaves Iran Out Of Major Investment Projects

Despite close political relations with China, Iran has been largely left out of Beijing’s Belt and Road Initiative and other regional investments, amid US sanctions. China is connected to Southeast and South Asia, Central Asia, the Pacific Ocean, Africa, and Europe through the Belt and Road Initiative (BRI), a massive …

Read More »The U.S.-Iran Prisoner Swap: Unraveling Impacts on Gulf Security and Oil Dynamics

The recent agreement between the United States and Iran could portend well for regional security—or it could reinforce existing divisions and promote further escalatory behavior from each side, with significant economic consequences in either case. The recently announced prisoner swap between the United States and Iran has spurred debates about how it …

Read More »