Iran’s oil minister Javad Owji claimed on Wednesday that the country is producing 3.4 million barrels per day (mb/d) of crude oil, about 1.2 mb/d more than in mid-2021. In recent months, Owji has consistently reported oil production growth figures that contradict estimates from international entities. Both OPEC and the …

Read More »China Leaves Iran Out Of Major Investment Projects

Despite close political relations with China, Iran has been largely left out of Beijing’s Belt and Road Initiative and other regional investments, amid US sanctions. China is connected to Southeast and South Asia, Central Asia, the Pacific Ocean, Africa, and Europe through the Belt and Road Initiative (BRI), a massive …

Read More »Iran Dreams Of Energy Cooperation With Russia

While none of the dozens of deals between Iranian and Russian oil companies over the past decade have been implemented, Russia now intends to export gas to Iran. It should be noted that due to European sanctions, Russia faced serious challenges in selling natural gas. Simultaneously, during the three-day visit …

Read More »The U.S.-Iran Prisoner Swap: Unraveling Impacts on Gulf Security and Oil Dynamics

The recent agreement between the United States and Iran could portend well for regional security—or it could reinforce existing divisions and promote further escalatory behavior from each side, with significant economic consequences in either case. The recently announced prisoner swap between the United States and Iran has spurred debates about how it …

Read More »Mutual Interests and Geopolitical Considerations in Iran-Venezuela Energy Ties

Key PointsMutual interests and geopolitical considerations have long influenced the Iran-Venezuela energy relationship. Iran aims to increase Venezuela’s refining capacity by revamping its refining complex and reducing its reliance on US technology.Despite the rise in petroleum prices, trade and investment between Iran and Venezuela will continue to be limited due to their …

Read More »Iran’s oil and gas industry a year after the war in Ukraine

Introduction Despite its abundant oil and gas reserves, over the last four decades Iran has not been able to play a prominent role in the global energy market. According to energy industry statistics, Iran requires at least US$160 billion in investment to continue to export its oil and natural gas. …

Read More »The Iran-Afghanistan Water Dispute: Implications, Challenges, and Potential Resolutions

Key Points Iran and Afghanistan have historically relied heavily on their shared water resources, particularly those in the Helmand River basin. A simmering disagreement over water allocation brought on by their shared struggles with drought, climate change, and water mismanagement puts their alliance in jeopardy. Even though Iran and Afghanistan do not have …

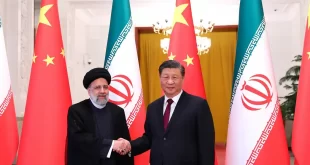

Read More »Obstacles and opportunities for closer Iranian-Chinese economic cooperation

Iranian-Chinese economic relations have grown steadily closer over the past four decades, with Beijing emerging as one of Tehran’s leading trade partners in recent years. Their economic relationship entered a new phase in the 1980s, when China started providing Iran with arms and technology during the Iran-Iraq War. But since …

Read More »North-South Transport Corridor: Iran-Russia New Railway to Circumvent Western Pressure

The construction of the International North-South Transport Corridor is another way for Iran and Russia to circumvent Western sanctions and lower trade cost while increasing its volume. After the United States and the European Union imposed extensive sanctions on Russia in response to its invasion of Ukraine in February 2022, …

Read More »Iran-Iraq competition in regional maritime and overland transit corridors

In recent years, Iraq has become one of the leading destinations for Chinese investments in the Middle East and a crucial link in Beijing’s Belt and Road Initiative (BRI). To capitalize on its geostrategic location and central position within the Chinese BRI, Iraq is seeking to develop a sprawling new 54-square-kilometer port …

Read More »